- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Crocs (CROX) Stock Dives on Agreement to Acquire HEYDUDE

The Crocs (NASDAQ:CROX) Inc. CROX stock nosedived 11.6% on Dec 23, after witnessing consistent growth in the past year only on its decision to acquire privately-owned HEYDUDE for $2.5 billion. The company signed a deal to buy competitor HEYDUDE, which sells lightweight, casual shoes and sandals for men, women and children. With the acquisition, Crocs looks to add value to its fast-growing footwear business.

Per the deal, Crocs is likely to pay $2.05 billion in cash and $400 million in the form of Crocs’ shares issued to HEYDUDE’s founder and chief executive, Alessandro Rosano. The company expects to pay the cash consideration by entering a $2-billion Term Loan B Facility and borrowing $50 million under its existing Senior Revolving Credit Facility. The company expects to conclude the transaction in first-quarter 2022, following the satisfaction of customary closing conditions and regulatory approvals.

On the acquisition completion, HEYDUDE will operate as a stand-alone division. HEYDUDE’s founder and chief executive will continue to overlook the innovative product development of the brand designated as the strategic advisor and creative director.

Crocs believes HEYDUDE’s consumer-insight-driven casual, comfortable and lightweight products perfectly fit its existing portfolio. The acquisition is expected to be immediately accretive to Crocs’ revenues, operating margins and earnings in 2022. The company expects to deleverage quickly through the acquisition, driven by additional cash flow generation and margin growth. Crocs notes that HEYDUDE has generated robust revenues and profits in the past few years.

Moreover, the acquisition is likely to diversify Crocs’ brand portfolio and add to its digital penetration, as HEYDUDE already has a strong online presence. HEYDUDE generates about 43% of sales from its online business compared with 36.8% of Crocs’ sales coming from online in third-quarter 2021. HEYDUDE is expected to generate revenues of $570 million in 2021.

Per analysts, Crocs plans to expand the HEYDUDE into a $1-billion brand by 2024, following the completion of the acquisition. This is in sync with Crocs’ plans to generate $5 billion in sales by 2026, witnessing compounded annual growth rate (CAGR) of more than 17% in the next five years. The company anticipates at least 50% of total revenues from digital channels by the end of 2026. On its October earnings call, Crocs predicted revenue growth of 62-65% for 2021 from $1.39 billion reported in 2020.

What’s More?

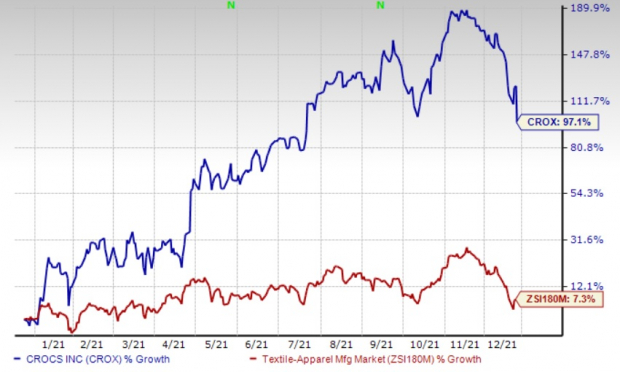

Crocs shares rallied 97.1% in the past year, driven by the increasing popularity of casual footwear during the pandemic as consumers switched from formal wear to more comfortable footwear. The Zacks Rank #3 (Hold) company’s gain significantly outpaced the industry’s growth of 7.3% in the same period.

Sturdy consumer demand and brand strength have been contributing to Crocs’ robust growth story. The company’s focus on product innovation and marketing, digital capabilities, and tapping of growth opportunities in Asia also bode well.

Crocs’ timely actions helped mitigate the impacts of factory closures in Vietnam, its major manufacturing hub, and the global supply-chain bottlenecks in the third quarter. The company took immediate action to shift production, enhance factory throughput, leverage air freight, and strategically allocate units.

It remains optimistic about navigating through the tough times. Notably, it is shifting production capacity to countries, namely China, Indonesia and Bosnia. Management notified that the company can ramp up factory production due to the limited inputs and simple configuration of products. Crocs is also planning to lower its dependency on West Coast ports by adding East Coast transshipment capabilities to reach key customers in the United States.

In spite of the temporary disruptions, Crocs anticipates revenues growth of more than 20% in 2022, fueled by brand strength and consumer demand globally. Wholesale orders for the first half of 2022 have been exceptionally strong. To strengthen inventory positions across all its regions for the first half of 2022, Crocs plans to invest $75 million in air freight.

Stocks to Watch

We have highlighted some better-ranked stocks from the same industry, namely Delta Apparel (NYSE:DLA) DLA, Guess (NYSE:GES) GES and Under Armour (NYSE:UA) UAA.

Delta Apparel, a Zacks Rank #1 (Strong Buy) stock at present, has a trailing four-quarter earnings surprise of 95.5%, on average. The DLA stock has gained 37.6% in a year’s time.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Delta Apparel’s current financial-year sales and earnings per share suggests growth of 11.6% and 9.4%, respectively, from the year-ago period’s reported numbers.

Guess currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 97%, on average. Shares of GES have risen 14.1% in the past year.

The Zacks Consensus Estimate for Guess’ current financial-year sales suggests growth of 38.6% and the same for earnings per share indicates substantial growth from the year-ago period’s reported figures.

Under Armour currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 244.5%, on average. Shares of UAA have gained 18.4% in the past year.

The Zacks Consensus Estimate for Under Armour’s current financial-year sales and earnings per share suggests growth of 25% and 396.2%, respectively, from the year-ago period’s reported numbers. UAA has an expected long-term earnings growth rate of 25%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guess, Inc. (GES): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

Delta Apparel, Inc. (DLA): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.