- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

Coty (COTY) Stock Gains Over 9% On Q1 Earnings & Sales Beat

Coty Inc. (NYSE:COTY) posted first-quarter fiscal 2018 results, wherein both top and bottom lines surpassed the Zacks Consensus Estimate with the former marking its third straight beat. While the top line surged considerably thanks to gains from buyouts, organic sales declined year over year owing to weakness in the Consumer Beauty segment.

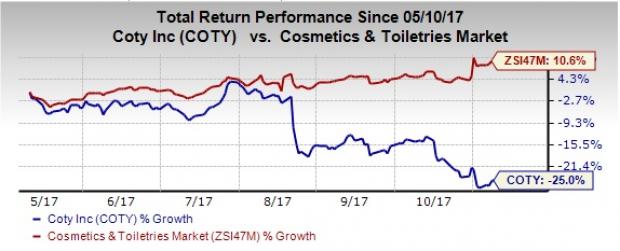

Nonetheless, the better-than-expected results and Coty’s solid ongoing prospects seems to have encouraged investors. Evidently, shares of the Zacks Rank #3 (Hold) company are up 9.1% in the pre-market trading session. Let’s see if this can bring a turnaround to Coty’s past stock performance, as shares of this cosmetics company have plunged 25% in the past six months, as against the industry’s 10.6% gain.

The company’s adjusted earnings of 10 cents per share slumped 57% year over year, while it surpassed the Zacks Consensus Estimate of 7 cents. On a GAAP basis, the company reported a loss of 3 cents per share.

Quarter in Detail

The company generated revenues of $2,238.3 million, which topped the Zacks Consensus Estimate of $2,224 million. Further, revenues surged over 100% year over year, driven by contributions from the P&G Beauty business buyout. Also, contributions from the acquisitions of ghd and Younique aided sales growth. On a constant currency basis, revenues increased 5%.

Excluding the impacts from ghd and Younique, organic revenues of the combined company (Legacy-Coty and P&G Beauty Business) dipped 2% on a constant currency basis. This was mainly accountable to softness in the company’s Consumer Beauty segment, somewhat compensated by solid growth in the Luxury unit and modest improvement in the Professional Beauty unit.

Adjusted gross margin expanded 280 basis points to 61.6% in the quarter thanks to the buyouts of higher margin businesses, as well as synergies from supply chain and procurement. While adjusted operating income jumped 17% to $195.1 million, adjusted operating margin contracted 670 basis points to 8.7% in the quarter.

Segment Details

Luxury: Luxury net revenues surged 70% to $764.4 million on a reported basis, backed by gains from the P&G Beauty business buyout. On a currency neutral basis, the combined company’s revenues rose 4%, attributable to strength in Hugo Boss, Tiffany & Co. (NYSE:TIF) and Gucci. Adjusted operating income for Luxury remained flat year over year at $90.6 million in the quarter.

Consumer Beauty: Consumer Beauty soared 82% to $1,043.4 million on a reported basis, driven by contributions from Younique and P&G Beauty business. On a currency-neutral basis, net revenues of the combined company climbed 2%, thanks to 10% contribution from Younique, largely offset by an 8% drop in underlying revenues of the combined entity. The latter stemmed from continued sluggishness in the global mass beauty space and weak performance of some retail hair brands. Adjusted operating income for Consumer Beauty advanced 54% to $88.3 million.

Professional: Professional Beauty net revenues of $430.5 million improved over 100%, driven by gains from P&G Beauty business and ghd buyouts. On a currency-neutral basis, sales grew 13% for the combined entity, including 12% gains from ghd and consistent strength in Wella and System Professional sales. This was partly mitigated by lower Clairol Professional sales. Adjusted operating income for Professional dipped marginally to $16.9 million.

On a region-wise basis, net revenues surged over 100% (on a reported basis) across North America and Europe, driven by Younique and ghd’s contributions, respectively. However, the respective sales were partly hampered by softness in the United States and Germany. Sales at the ALMEA region jumped 74% on a reported basis.

Other Financial Updates

Coty ended the quarter with with cash and cash equivalents of $919.2 million, long-term debt (net) of $7,541.9 million and total shareholders’ equity of $9,452.3 million (excluding non-controlling interests).

The company used net cash from operating activities of $8.9 million and free cash flow in the quarter amounted to negative $120.3 million.

In a separate press release, the company also announced a dividend of 12.5 cents per share, payable on Dec 14 to shareholders of record as on Nov 30. Further, on Sep 14, the company paid a quarterly dividend of 12.5 cents per share for a total of $93.6 million.

Other Developments

Earlier this month, the company concluded the buyout of its unique international license rights for Burberry Beauty luxury fragrances, cosmetics and skincare, which will extend over the long term.

Outlook

Management remains pleased with the solid growth at its Luxury business and ongoing momentum at the Professional segment. Further, enhanced gross margin and effective cost management helped the company log higher profits. The company remains optimistic about the ongoing synergies from buyouts, which have been solidifying its portfolio. That said, the company expects improved net revenue growth in the remainder of fiscal 2018, with organic sales likely to remain flat year over year in the second half of the fiscal. Management also expects healthy margin improvement over the remainder of fiscal 2018.

Looking for More Promising Bets? Check These Trending Picks

The Estée Lauder Companies Inc. (NYSE:EL) has a long-term earnings growth rate of 12.5% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inter Parfums Inc (NASDAQ:IPAR) , with a Zacks Rank #2 (Buy) has a long-term earnings growth rate of 12.3%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation

See Them Free>>

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Coty Inc. (COTY): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Tiffany & Co. (TIF): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.