- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Costco's (COST) Q2 Earnings Surpass Estimates, Increase Y/Y

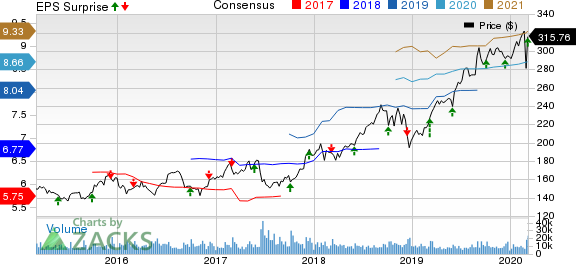

Costco Wholesale Corporation (NASDAQ:COST) posted fifth straight quarter of positive earnings surprise, when it reported second-quarter fiscal 2020 results. Total revenues also surpassed the Zacks Consensus Estimate, after missing the same in the preceding quarter. Notably, both the top and the bottom line continued to register year-over-year improvement. The company also delivered decent comparable sales growth across all regions.

With Thanksgiving happening a week later this year compared with the prior year, second-quarter total and comparable sales were favorably impacted by roughly 0.5%. Moreover, management highlighted that e-commerce sales were positively impacted by an estimated 11 percentage points.

Quite apparent, Costco’s better price management and strong membership trends have been playing a crucial role in driving comparable sales. We note that shares of this Zacks Rank #2 (Buy) company have gained 7% against the industry’s decline of 0.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Q2 Earnings & Sales Picture

This Issaquah, WA-based company reported earnings of $2.10 per share. The quarterly earnings not only came ahead of the Zacks Consensus Estimate of $2.07 but also improved 4.5% from the year-ago quarter figure.

Total revenues, which include net sales and membership fee, came in at $39,072 million, up 10.4% from the prior-year quarter. The figure also beat the Zacks Consensus Estimate of $38,366 million.

In the reported quarter, the company’s e-commerce comparable sales rose 28.4% year over year. Excluding the effect of gasoline prices and foreign exchange, the same exhibited an improvement of 28% year over year.

With the prevailing trend of digital transformation in the sector, retailers are rapidly adopting the omni-channel mantra to provide a seamless shopping experience online and in stores. Costco, which shares space with Walmart (NYSE:WMT) , Amazon (NASDAQ:AMZN) and Target (NYSE:TGT) , is also following the trend. Costco operates e-commerce sites in the United States, Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

Delving Deeper

Costco’s net sales grew 10.5% to $38,256 million, while membership fee increased 6.3% to $816 million. Comparable sales for the reported quarter improved 8.9%, reflecting an increase of 9.1%, 8.9% and 7.9% in the United States, Canada and Other International locations, respectively.

Excluding the impact of foreign currency fluctuations and gasoline prices, the company witnessed comparable sales growth of 7.9% during the quarter. Notably, the United States, Canada and Other International locations registered comparable sales growth of 8.1%, 6.8% and 7.1%, respectively.

Traffic or shopping frequency rose 5.9% globally and 6.1% in the United States. Average transaction improved 2.9% on a year-over-year basis.

The company witnessed comparable sales growth of 12.1% for the month of February. Further, net sales rose 13.8% year over year to $12.20 billion. E-commerce comparable sales surged 22.6% in the month under review.

Operating income in the quarter increased 5.2% year over year to $1,266 million, while operating margin (as a percentage of total revenues) shrunk 20 bps to 3.2%.

Store Update

Costco currently operates 785 warehouses, comprising 546 in the United States and Puerto Rico, 100 in Canada, 39 in Mexico, 29 in the U.K., 26 in Japan, 16 in Korea, 13 in Taiwan, 11 in Australia, two in Spain, one each in Iceland, France and China.

Financial Aspects

Costco ended the reported quarter with cash and cash equivalents of $7,786 million and long-term debt (excluding current portion) of $5,099 million. The company’s shareholders’ equity was $16,614 million, excluding non-controlling interests of $385 million.

Management incurred capital expenditures of $545 million during the quarter under review, and plans to spend approximately $3 billion during the fiscal year.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Target Corporation (TGT): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Original post

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.