- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus, Tariffs Mar Chemical Specialty Industry Outlook

The Zacks Chemicals Specialty industry consists of manufacturers of specialty chemical products for a host of end-use markets such as textile, paper, automotive, electronics, personal care, energy, construction and agriculture. These chemicals (including catalysts, surfactants, speciality polymers, coating additives, pesticides and oilfield chemicals) are used based on their performance and have a specific purpose. They have application in the manufacturing process of a vast range of products, including paints and coatings, cosmetics, petroleum products, inks, and plastics.

Some of the prominent industry players are Celanese Corporation (CE), Ashland Global Holdings Inc. (ASH), W. R. Grace & Co. (GRA) and Ingevity Corporation (NGVT).

Here are the industry’s three major themes:

- Companies in the chemical specialty space face headwind from weak demand due to the coronavirus outbreak. They are likely to witness short-term demand weakness in China, a top consumer of chemicals, as coronavirus-induced shutdowns are hurting industrial activities in the country. The contagion has slowed down activities in the construction space (a key chemical end-use market) in China due to quarantine restrictions on workers who returned from the Lunar New Year holidays. The automotive industry, another major end-market for chemicals, is also getting hammered by the outbreak.

- Trade tariffs remain a drag on the chemical specialty industry. The United States and China have imposed billions of dollars in punitive tariffs on each others’ products. China’s tariffs on American products include a wide range of chemical products, including specialty chemicals. While the completion of the initial trade deal averted the implementation of a new round of tariff on chemicals, the steep tariffs currently in place are already doing damage to the industry. China is among the most important trading partners of the American chemical industry and is one of the biggest export markets for U.S. chemicals. Beijing’s retaliatory tariffs are hurting U.S. chemical exports.

- Specialty chemical makers are grappling with short supply of raw materials as a result of coronavirus. The closure of a large number of factories across China to contain the spread of the virus has disrupted the global supply chain. This in turn is expected to push up prices of inputs. Higher raw material prices are, thus, likely to squeeze margins of chemical specialty companies over the short haul.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Chemicals Specialty industry is part of the broader Zacks Basic Materials sector. It carries a Zacks Industry Rank #209, which places it at the bottom 17% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates a gloomy near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. Over the past year, the industry’s earnings estimate for the current year has gone down 20%.

Despite the industry’s grim near-term prospects, we will present a few stocks worth considering for your portfolio. But before that, it’s worth taking a look at the industry’s stock market performance and current valuation.

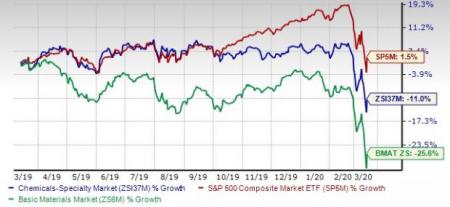

Industry Lags S&P 500

The Zacks Chemicals Specialty industry has lagged the Zacks S&P 500 composite over the past year. The industry has lost 11% over this period compared with the S&P 500’s rise of 1.5%. Meanwhile, the broader Zacks Basic Materials sector has tumbled 25.6% over the past year.

One-Year Price Performance

Industry’s Current Valuation

On the basis of trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing chemical stocks, the industry is currently trading at 20.64X, above the S&P 500’s 11.04X and the sector’s 8.05X.

Over the past five years, the industry has traded as high as 25.21X, as low as 16.83X, with a median of 22.38X, as the chart below shows.

Enterprise Value/EBITDA (EV/EBITDA) Ratio

.jpg)

Enterprise Value/EBITDA (EV/EBITDA) Ratio

Bottom Line

Chemical specialty companies are bearing the brunt of hefty trade tariffs. Moreover, disruptions associated with the coronavirus outbreak are expected to hurt demand over the short term. Margins of these companies will also likely remain under pressure over the near term amid an inflationary environment given raw material supply constraints resulting from the contagion.

We are presenting one stock with a Zacks Rank #1 (Strong Buy) that is well positioned to grow. There are three other stocks with a Zacks Rank #3 (Hold) that investors may hold on to for now. You can see the complete list of today’s Zacks #1 Rank stocks here.

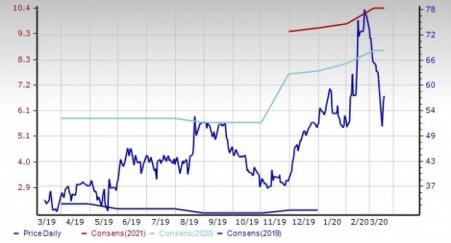

Daqo New Energy Corp. (DQ): The Zacks Consensus Estimate for this China-based company’s current-year earnings has gone up 6.4% in the last 60 days. The company, sporting a Zacks Rank #1, has an expected earnings growth rate of 353.7% for 2020.

Price and Consensus: DQ

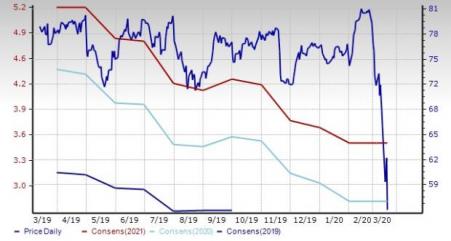

Axalta Coating Systems Ltd. (AXTA): The Pennsylvania-based company, carrying a Zacks Rank #3, has an expected earnings growth rate of 5% for 2020. The company also delivered positive earnings surprises in three of the trailing four quarters, the average positive surprise being 23.5%.

Price and Consensus: AXTA

Ashland Global Holdings Inc: The Kentucky-based company, carrying a Zacks Rank #3, has an expected earnings growth rate of 13.6% for the current fiscal year. It also has an estimated long-term earnings growth rate of 6.5%.

Price and Consensus: ASH

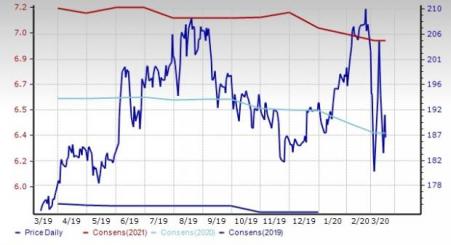

Ecolab Inc (NYSE:ECL). (ECL): This Minnesota-based company carries a Zacks Rank #3 and has an expected earnings growth rate of 9.5% for 2020. Moreover, it has an estimated long-term earnings growth rate of 12.2%.

Price and Consensus: ECL

Ingevity Corporation (NGVT): Free Stock Analysis Report

W.R. Grace & Co. (GRA): Free Stock Analysis Report

Ecolab Inc. (ECL): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA): Free Stock Analysis Report

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

Original post

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.