- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus Stress Propels Hilton To Withdraw 2020 Guidance

The devastating impact of the novel coronavirus outbreak (COVID-19) on the global economy has led Hilton Worldwide Holdings Inc. (NYSE:H) to withdraw its previously announced first-quarter and 2020 guidance.

This deadly severe acute respiratory syndrome coronavirus 2, or SARS-CoV-2 has claimed too many lives so far and is expected to weigh on the global economy in trillions.

The President & Chief Executive Officer of Hilton, Christopher J. Nassetta said, "With the coronavirus now spreading beyond China and the Asia Pacific region, and the related increase in travel restrictions and cancellations around the world, we believe that the potential negative impact will be greater than our previous estimate and have decided to withdraw our previously announced guidance.”

However, the company remains confident about its prospects on the back of resilient business model, leading brand portfolio and the ability to respond appropriately to market conditions.

Christopher J. Nassetta stated that the first priority is to support the guests and team members affected by coronavirus.

Coronavirus Crisis Hits Hotel Industry

The travel industry has been experiencing its worst phase in the past several years. The company has already closed roughly 150 hotels in China, having 33,000 rooms. Notably, China represented 2.7% of the overall EBITDA and 0.7% of system-wide revenues in 2019.

Other major hoteliers like Wyndham Hotels & Resorts, Inc. (NYSE:H) , Hyatt Hotels Corp. (NYSE:H) and Marriott International, Inc. (NASDAQ:MAR) have also been impacted by the coronavirus outbreak.

Per reports, Wyndham Hotels & Resorts has shut 1,000 hotels in China, which represents nearly 75% of its operations in China. Moreover, Hyatt and Marriott have closed nearly 26 and 90 hotels in the country, respectively.

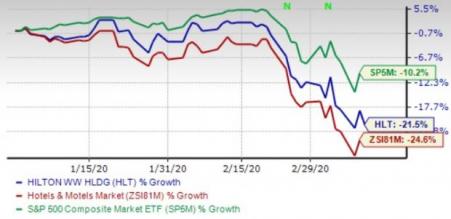

So far this year, shares of the company have declined 21.5%, the industry has decreased 24.6%, while the S&P 500 has plummeted 10.2%.

Zacks Rank

Hilton currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Marriott International, Inc. (MAR): Free Stock Analysis Report

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Free Stock Analysis Report

Wyndham Hotels & Resorts Inc. (WH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.