- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus Spreads Rapidly Worldwide: Medtech Stocks In Focus

The new strain of coronavirus is spreading rapidly across the world and has recently picked up pace outside China. Per the latest announcement made by World Health Organization (WHO) chief Tedros Adhanom Ghebreyesus, almost eight times as many cases have been reported outside China in the previous 24 hours.

This has dealt a blow to U.S. Medtech stocks, as the country relies heavily on imports from China. Evidently, the Dow Jones U.S. Medical Equipment Index has declined 7.5% since the beginning of this year when China alerted the World Health Organization (WHO) about this virus’ growth.

Coronavirus Impact on Medtech Stocks

Per a report by Business Insider, the United States currently makes up more than 30% of China's medical device and diagnostics imports. This surely reflects the dependence of the United States on China in the Medical sector and the potential of the health emergency to disrupt the global supply chain.

Meanwhile, the death toll has risen to nine in the United States and at least 120 cases of coronavirus have been recorded in more than a dozen states. This has raised the possibility of a coronavirus outbreak in the United States, thereby increasing the probability of an economic downturn. The potential disruption in global supply chain and probable economic crisis must have made investors skeptical about Medtech stocks’ growth, which got reflected in the year-to-date decline in the Medical Equipment Index.

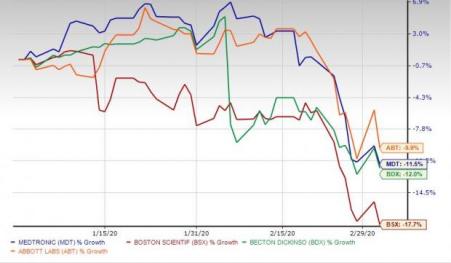

Evidently, shares of some of the largest companies in the medical device sector — Medtronic, Boston Scientific, Becton, Dickinson and Abbott Laboratories — have declined between 9% and 13% on a year-to-date-basis.

Stocks in Focus

Boston Scientific (NYSE:BSX) stated on its fourth-quarter earnings call that it expects to face adverse procedure volumes in China and supply chain problems related to the coronavirus. This in turn is projected to impact the company’s first-quarter sales in the range of $10 million to $40 million.

Becton Dickinson (NYSE:BDX) mentioned on its first-quarter fiscal 2020 earnings call that it expects to witness a headwind of $20 million to $30 million in fiscal 2020. From a supply chain perspective, the company currently has sufficient inventory of the products that it exports from China to meet current demand. However, considering the rapid spread of the virus, we remain skeptical about the time till it which it can sustain on its current inventory.

Medtronic (NYSE:MDT) has multiple manufacturing and research facilities across China, which contribute nearly 7% of its total revenues. This has led the company to estimate that its fiscal fourth-quarter results will be hit by the supply chain disruption and production halt in China. As the Chinese healthcare system is focused on containing the spread of the virus, hospitals in the country are experiencing a slowdown in medical device procedure rates. Medtronic is witnessing procedure delays.

Much of Abbott Laboratories’ (NYSE:ABT) manufacturing in China is centered on its nutritional products. China is a significant market for Abbott’s infant formula business, said Debbie Wang, a senior equity analyst at Morningstar. She said Abbott’s overall sales in the first quarter could be soft as a result of the virus. It’s also possible that Abbott, which sells generic drugs outside the United States, could, like other companies selling pharmaceuticals, have a tough time making these drugs as a number of active ingredients for medications come from China, Wang said.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Medtronic PLC (MDT): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.