- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus Hits Elective Procedures: 3 MedTech Stocks To Avoid

Since the first detection in central China in December, coronavirus has turned into a full-blown pandemic, and its panoptic impact has left the world rattled and shocked. As of Mar 26, the number of people infected globally has exceeded 460,000, while the number of deaths recorded is at least 21,200. In the United States alone, there are at least 65,201 cases with the death toll at 928, so far.

According to another CNBC report, analysts from the Economic Intelligence Unit (“EIU”) anticipates the virus to infect about 50% of the world population, with 20% cases being severe and 1-3% resulting in deaths. Consequently, EIU projected global growth to stand at 1% in 2020 (down from the expectation of 2.3% before the coronavirus outbreak). Analysts also added that it would mark the lowest rate in global gross domestic product (GDP) growth since the global financial crisisin 2008.

Crippling Economic Impact

The U.S. economic outlook looks dreary with millions now facing unemployment and businesses witnessing a steep decline. The coronavirus (also termed as COVID-19) fallout has been so severe that many economists are of the opinion that the United States is heading into a recession.

Per a report by The New York Times, Greg Daco, chief U.S. economist at Oxford Economic, is certain that the economy is heading for a deep recession with at least two consecutive quarters of economic decline (with output projected to fall 0.4% in the first quarter and 12% in the second). This would reflect the biggest quarterly contraction on record. Goldman Sachs (NYSE:GS), estimates this contraction to be as much as 24% in the second quarter.

Elective Procedures in MedTech Reeling Under the Coronavirus Impact

Going by a MedTech Dive report, Moody’s Investors Service has lowered its outlook for the medical device sector from positive to stable, citing a global economic slowdown and shift in healthcare resources toward combating the novel coronavirus.

Elective procedures have been lucrative for MedTech companies but the outbreak has put the same under significant threat. CMS has urged hospitals to postpone non-essential elective surgeries, such as hip and knee replacements, and focus on preparing for COVID-19 patients. The United States could witness 3-4% of procedures impacted across orthopedics and interventional cardiology. This disruption is expected to dent MedTech sales in the near term.

Robotic Surgery giant, Intuitive Surgical (NASDAQ:ISRG) , has already witnessed disruptions to procedures and delays in case of new system placements due to the coronavirus outbreak. The company anticipates the procedure volume and system replacement disruption to intensify with the coronavirus outbreak showing no signs of letting up.

Stocks Grappling With Coronavirus Crisis

Needless to say, that the panic triggered by the escalating coronavirus pandemic has been weighing heavily on investors sentiments by sending markets into frenzy. Here we will look at three MedTech stocks that have been struggling to combat this coronavirus-induced crisis.

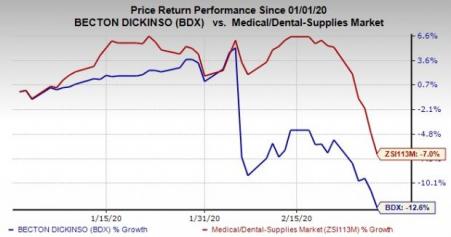

Becton, Dickinson and Company (NYSE:BDX) , also known as BD, has mentioned in its first-quarter fiscal 2020 earnings call that it expects to witness a headwind of $20-$30 million in fiscal 2020. From a supply chain perspective, the Zacks Rank #4 (Sell) company currently has sufficient inventory of the products that it exports from China to meet current demand levels. However, considering the rapid spread of the virus, we remain skeptical regarding the company’s operational capability following the end of current inventory.

Over the past two months, the company’s shares have lost 12.6%, compared with the industry’s decline of 7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abiomed, Inc.’s (NASDAQ:ABMD) flagship product line, Impella (world’s smallest heart pump), is a support system of percutaneous, catheter-based devices offering hemodynamic support to the heart. With interventional cardiology procedures expected to take a hit, the product line is likely to be under pressure in the near term.

This Zacks Rank #4 stock has lost 11.9% over the past two months, compared with the industry’s decline of 5.9%.

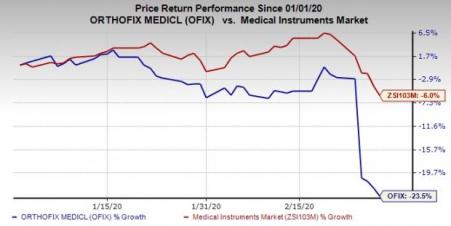

Orthofix Medical Inc. (NASDAQ:OFIX) develops, produces and markets medical devices. The company offers spine fixation, biological and other orthopedic and spine solutions. As discussed above, orthopedic procedures are anticipated to bear an impact due to this outbreak and as a result the company’s product line might take a hit.

This Zacks Rank #5 (Strong Sell) stock has lost 23.5% over the past two months, compared with the industry’s decline of 6%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

ORTHOFIX MEDICAL INC. (OFIX): Free Stock Analysis Report

ABIOMED, Inc. (ABMD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.