- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cooper Companies (COO) Tops Q1 Earnings & Revenue Estimates

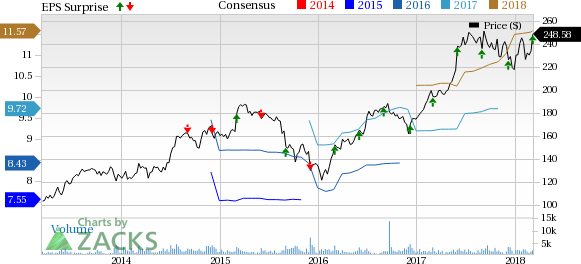

Cooper Companies Inc. (NYSE:COO) reported adjusted earnings of $2.79 in first-quarter fiscal 2018, beating the Zacks Consensus Estimate by 10.7% and increasing 44.6% year over year. We believe the upside was driven by robust revenue growth. The stock has a Zacks Rank #3 (Hold).

Revenues increased 4% at constant currency exchange rate (CER) on a year-over-year basis to $590 million. The figure also outpaced the Zacks Consensus Estimate of $582.1 million. The stellar top-line performance was driven by silicone hydrogel lenses, led by the Clariti and MyDay in the dailies space and Biofinity in the monthly space.

Segmental Analysis

The company has two business segments — CooperVision (CVI) and CooperSurgical (CSI).

CVI

Revenues at CooperVision Segment increased 8% at constant currency (cc) to $444.8 million on a year-over-year basis. The segment continues to gain from the company’s silicone hydrogel lenses led by solid prospects in the MyDay, Clariti and Biofinity platforms. Coming to the major catalysts within the CVI segment, robust performance by Toric (31% of CVI revenues), Multifocal (11%), single-use sphere lenses (26%) and non single-use sphere lenses (32%) propelled solid growth.

Multifocal revenues rose 5% year over year at cc to $46.9 million, while Toric revenues increased 9% to $137.8 million. Single-use sphere lenses sales climbed 11% at cc to $116.3 million, while sales of non single-use sphere lenses rose 4% to $143.8 million.

Geographically, CVI revenues inched up 3% in the Americas and a respective 15% and 9% in the Asia Pacific and EMEA, at cc.

CSI

Revenues at CooperSurgical Segment declined 6% at cc to $145.2 million on a year-over-year basis. However, the company witnessed 32% increase in this segment on a reported basis on the back of the PARAGARD acquisition. The fertility category (39% of CSI revenues) saw a 5% drop in sales at cc to $57 million. Also, the office and surgical products category declined 6% at cc to $88.2 million.

Margin Details

As a percentage of revenues, adjusted gross margin at the CSI segment was 69% in the reported quarter, up 700 basis points (bps) year over year. The margin was negatively impacted by the inventory step-up associated with the PARAGARD buyout.

As a percentage of revenues, adjusted gross margin at the CVI segment was 67% in the reported quarter, higher than 63% of revenues in the year-ago quarter. This reflects an increase of 400 bps on f avorable currency and product mix.

Hence, adjusted gross margin as a whole for Cooper Companies was 68% of revenues, up 500 bps year over year.

Adjusted operating margin, as a percentage of revenues, was 28% of net revenues in the fiscal first quarter, up 500 bps on a year-over-year basis.

Guidance

For fiscal 2018, total revenues are now expected in the band of $2,510-$2,560 million compared with the previous $2,480-$2,530 million. The Zacks Consensus Estimate for fiscal 2018 revenues is pegged at $2.52 billion, within the guided range.

Revenues at the CVI segment are now estimated in the band of $1,865-$1,900 million, higher than $1,830-$1,865 million. Meanwhile, CSI revenue range has been slashed to $645-$660 million from the prior $650-$665 million.

Adjusted earnings per share are now anticipated in the band of $11.70-$11.90 versus $11.35-$11.65 earlier. The Zacks Consensus Estimate for fiscal 2018 adjusted earnings stands at $11.57, below the guided range.

Our Take

Cooper Companies ended first-quarter fiscal 2018 on a solid note. The company’s CooperVision business has always been posting impressive results. The company’s raised guidance for fiscal 2018 is promising. However, intense competition in the contact lens space will continue to increase pricing pressure for the company.

Notably, Cooper Companies has completed the acquisition of Paragon Vision Sciences. This added a leading ortho-k technology to the company’s lens portfolio. Considering the outstanding performance of the stock, we expect Cooper Companies to scale higher in the coming quarters. In this regard, positive long-term growth of 10.8% holds promise.

Key Picks

A few better-ranked stocks that reported solid results this earnings season are PetMed Express (NASDAQ:PETS) , PerkinElmer (NYSE:PKI) and athenahealth, Inc. (NASDAQ:ATHN) . While PetMed and athenahealth sport a Zacks Rank #1 (Strong Buy), PerkinElmer carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported third-quarter fiscal 2018 results. Adjusted earnings per share of 44 cents were up 88.3% from the prior-year quarter. Revenues rose 13.7% to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted earnings per share of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million a year ago.

athenahealth reported adjusted earnings per share of $1.11 in the fourth quarter of 2017, up 79% year over year. Revenues totaled $329 million, up 14.2%.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

athenahealth, Inc. (ATHN): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

The Cooper Companies, Inc. (COO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.