- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Connecticut Water (CTWS) Down 6.5% Since Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for Connecticut Water Service, Inc. (NASDAQ:CTWS) . Shares have lost about 6.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Connecticut Water Q3 Earnings Top, Customers Increase

Connecticut Water Service reported third-quarter 2017 earnings of 90 cents per share, which surpassed the Zacks Consensus Estimate of 88 cents by 2.3%. Earnings were up 7.1% year over year.

The company is continuing with its inorganic growth strategy. Year to date, it has added 9,500 customers through acquisitions, reflecting a customer base growth of nearly 7.5%.

Total Revenues

In the quarter under review, Connecticut Water’s total revenues were $33.5 million, up 7.1% year over year, primarily on higher contribution from its Water Operation segment.

The year-over-year increase in revenues was due to benefits derived from the acquisition of the Heritage Village Water Company in February 2017 and the Avon Water Company in July 2017. In addition, the recovery of costs for completed infrastructure replacement projects also boosted revenues.

Segment Details

Water Operations contributed $33.5 million in the third quarter to total revenues compared with $29.8 million in the prior-year quarter.

Services & Rentals contributed $1.26 million in the quarter compared with $1.41 million a year ago.

Highlights of the Release

In the third quarter, the company’s total operating expenses were $19.5 million, up nearly 4.3% year over year.

Connecticut Water’s utility operating income in the reported quarter improved 15.6% year over year to $12.6 million.

The new $30 million Rockville Water Treatment Facility that went online this spring will help the company supply high quality water to nearly 85,000 customers.

Financial Update

As of Sep 30, 2017, Connecticut Water’s current assets were $47.2 million compared with $36.5 million as of Sep 30, 2016.

Net utility plant was worth $683.7 million as of Sep 30, 2017 compared with $583.8 million as of Sep 30, 2016.

Long-term debt as of Sep 30, 2017 was $255.2 million compared with $200.2 million as of Sep 30, 2016.

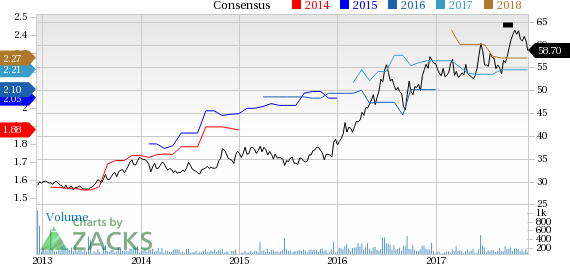

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Connecticut Water Service's stock has a poor Growth Score of F, however its Momentum is doing a lot better with a B. The stock was allocated a grade of F on the value side, putting it in the bottom 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum investors based on our style scores.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Connecticut Water Service, Inc. (CTWS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.