- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Conatus (CNAT) Loss Narrower Than Expected In Q4, Sales Miss

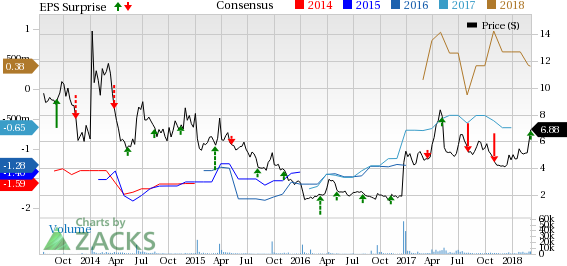

Conatus Pharmaceuticals Inc. (NASDAQ:CNAT) has reported fourth-quarter 2017 loss of 15 cents per share, narrower than both the Zacks Consensus Estimate of a loss of 17 cents and the year-ago loss of 35 cents.

Conatus’ shares were up 1.31% in after-hours trading on Mar 7 following the earnings release. Moreover, the company has outperformed the industry in a year’s time. While the stock has soared 55.3%, the industry has rallied 16.1%.

Conatus has no approved product in its portfolio at the moment. The company recognized $8.8 million as collaboration revenues in the period under review related to an agreement with Novartis AG (NYSE:NVS) , inked in December 2016 for the worldwide development and commercialization of its lead candidate, emricasan.

Revenues surged in the reported quarter compared with $0.8 million a year ago. This upside was driven by collaboration revenues reaped in the period compared with the same grossed over a span of 13 days in the prior-year quarter. However, the top line missed the Zacks Consensus Estimate of $10 million.

Per the deal, Novartis will share 50% cost of four ongoing phase IIb clinical studies (ENCORE program) on emricasan.

In the fourth quarter, research and development expenses were $10.9 million, up 67.7% from the year-ago quarter, mainly due to costs associated with the ongoing ENCORE trials.

General and administrative expenses were $2.3 million, down 34.3% from the year-ago quarter. This decrease was mainly on higher consulting and legal fees incurred by the company in December 2016 regarding the Novartis agreement’s execution.

Emricasan in Focus

Emricasan is being developed for treatment of patients with fibrosis or cirrhosis caused by nonalcoholic steatohepatitis (NASH).

With the initiation of ENCORE-LF study last year, there are now four prevalent phase IIb ENCORE studies on emricasan for the aforementioned indication. Data from all these programs are expected between 2018 and 2019. Positive results from these analyses will pave way for a phase III efficacy and safety trial on the candidate for the given disease.

The company also plans to begin a new study, ENCORE-XT, a planned extended assessment on patients, who completed the ENCORE-PH or ENCORE-LF studies with continued monitoring for efficacy, safety, clinical outcomes and health-related quality of life.

Apart from emricasan, the company’s portfolio consists of the candidate IDN-7314, being evaluated in a phase II study for treatment of primary sclerosing cholangitis (PSC). In October 2017, IDN-7314 was granted an Orphan Drug Designation (ODD) for the indication in the EU. Notably, the candidate already enjoys an ODD in the United States.

2017 Results

Full-year sales massively increased to $35.4 million compared with the year-earlier tally of $0.8 million. However, the same slightly lagged the Zacks Consensus Estimate of $36.2 million.

Full-year loss of 61 cents was significantly narrower than the loss of $1.31 a year ago. Moreover, the bottom line was narrower than the consensus mark of a loss of 64 cents.

Guidance

Conatus expects its 2018 year-end cash balance between $35 million and $40 million, much lower than $74.9 million at 2017-end.

However, with Novartis sharing half of Conatus’ development costs for phase IIb studies on emricasan, the latter expects its current financial resources to be sufficient for funding operations through the end of 2019.

Zacks Rank & Key Picks

Conatus carries a Zacks Rank #3 (Hold). Two better-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.37 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Ligand’s earnings per share estimates have been revised upward from $3.78 to $4.15 for 2018 and from $4.75 to $5.75 for 2019 in the last 30 days. The company delivered a positive surprise in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has jumped 57.3% over a year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Novartis AG (NVS): Free Stock Analysis Report

Conatus Pharmaceuticals Inc. (CNAT): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.