- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Community Health's (CYH) Q4 Loss Narrower Than Expected

Community Health Systems, Inc. (NYSE:CYH) reported adjusted loss of 25 cents per share in the fourth quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of 36 cents. However, adjusted loss incurred compares unfavorably with adjusted earnings of 46 cents in the year-ago quarter on lower revenues.

Net loss attributable to common stockholders was $17.98 per share in the fourth quarter, wider than net loss of $1.99 incurred in the year-ago period.

In the quarter under review, net operating revenues of $3,059 million missed the Zacks Consensus Estimate by 13% and decreased 31.6% year over year. The top line was adversely affected by a $591-million increase in contractual allowances and provision for bad debts.

Full-Year Update

For 2017, the company reported adjusted net loss of $1.20 per share against earnings of 46 cents in 2016.

Net operating revenues for 2017 totaled $15,353 million, down 16.7% year over year.

Quarterly Operational Update

The fourth quarter witnessed a 19.2% decrease in total admissions and a 19.3% fall in total adjusted admissions year over year.

In the reported quarter, total operating expenses rose 18.5% to $5.2 billion, primarily due to higher impairment and loss on sale of businesses.

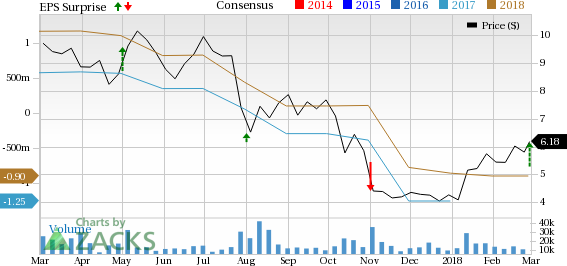

Community Health Systems, Inc. Price, Consensus and EPS Surprise

Financial Update

As of Dec 31, 2017, the company’s total assets declined 20% from year-end 2016 to $17.4 billion. Cash and cash equivalents increased 136% to $563 million from year-end 2016.

The company paid off a substantial portion of its debt through divestitures. It had long-term debt of $13.9 billion as of Dec 31, 2017, down 6% year over year.

Cash flow from operations was $156 million for the fourth quarter, down 52% year over year.

2018 Guidance

Loss from continuing operations per share is expected to lie within $1.50-$1.10.

Community Health expects net operating revenues in the range of $13.6-$13.9 billion.

The company projects adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) for 2018 in the range of $1,550-$1,650 million.

Weighted-average diluted shares are expected in the band of 113-114 million.

Zacks Rank and Performance of Other Insurers

Community Health carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the medical sector that have reported fourth-quarter earnings so far, the bottom line of Centene Corp. (NYSE:CNC) , Anthem Inc (NYSE:ANTM) and UnitedHealth Group Inc. (NYSE:UNH) beat the respective Zacks Consensus Estimate.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Anthem, Inc. (ANTM): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Community Health Systems, Inc. (CYH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.