- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Colfax To Grow On Brands & Acquisitions, Competition A Drag

We have issued an updated research report on Colfax Corporation (NYSE:CFX) on Nov 15. Strengthening end markets, efforts to innovate and introduce new products and synergistic benefits from acquired assets will prove beneficial. However, the growth momentum might get restricted by headwinds rising from international exposure, industry competition and global uncertainties.

Colfax currently carries a Zacks Rank #3 (Hold).

Below we briefly discuss the company’s potential growth drivers and possible headwinds.

Factors Favoring Colfax

Brands Strength: Colfax has evolved as a premier industrial tool provider in the past few years, with its market capitalization increasing from less than $1 billion in 2010 to roughly $4 billion at present. The company’s solid platforms — Fabrication Technology and Air & Gas Handling — that serves a diversified customer base in various end markets including general industrial, oil & gas, power, marine, mining and others have aided this significant growth.

ESAB is a popular brand under the Fabrication Technology business. Innovation and new product introductions are considered the keys to success. The global fabrication technology market is anticipated to grow roughly 3-4% in the long term. Technological advancements and shortage of skilled labors have boosted needs for more sophisticated equipments.

Howden, a popular brand under the Air & Gas Handling business, holds solid growth opportunities in emerging markets. The global air & gas handling is predicted to grow roughly 3-5% in the long run, driven by focus on energy efficiency, rise in infrastructure investments in developing nations and need for retrofits due to environmental regulations and performance upgrades.

Inorganic Initiatives Drive Growth Opportunities: Acquired assets have over time contributed to Colfax’s expansion. More than 20 businesses acquired since the 2012 Charter deal added roughly $1.6 billion in revenues. Notably, in the first nine months of 2017, acquired assets contributed roughly 1.3% to year-over-year sales growth.

Year to date, Colfax has acquired TBi, a leader in robotic torch technology, and HKS, a developer of advanced process analytics and sensors. These buyouts have strengthened the company’s welding process analytics and robotic welding torches operations in the Fabrication Technology segment. Also, in October, it completed the acquisition of Siemens AG’s Siemens Turbomachinery Equipment GmbH business. This strategic acquisition will solidify Colfax’s Howden trading platform.

In addition to acquisitions, divestment of non-core assets is Colfax’s another way of strengthening its core businesses. In September, it decided to sell its Fluid Handling business to CIRCOR for proceeds of approximately $860 million. It anticipates recording a material gain upon completion of the deal in the fourth quarter of 2017.

Healthy ‘17 Guidance & Long-Term Targets: Improving end-market conditions, inorganic growth expansion efforts, diversity in product portfolio and emerging market exposure are likely to spur Colfax’s growth potential in the quarters ahead. For 2017, the company anticipates adjusted earnings to be within $1.65-$1.75 per share, up from $1.56 recorded in 2016. Also, the company has initiated certain cost-reduction measures that will result in approximately $50 million in cost savings in 2017.

Over the long run (three to five years), the company anticipates organic growth (CAGR) in the range of 1-2% above Gross Domestic Product, and segment margins in the mid-teens level.

Factors Working Against Colfax

Threat From Industry Competition: Colfax faces active competition in the Air and Gas Handling business from companies offering similar products and services, or those producing different items for same uses. Also, other companies operating in the welding space provide stiff competition to its Fabrication Technology business.

Disadvantages of Diversification: Business expansion in foreign nations has exposed Colfax to risks arising from adverse movements in foreign currencies and geo-political issues. In the nine months ended September 2017, the company’s Air and Gas Handling’s orders declined 0.2% from the year-ago period due to adverse foreign currency translation. Moreover, as the company has to procure raw materials from suppliers both in the United States and international markets, it remains vulnerable to price fluctuations associated with policies and issues of the source countries.

Adversaries Rising From Global Uncertainty: End markets served by Colfax are highly susceptible to global economic conditions. Lower level of industrial activities and difficult financial conditions in countries where the company operates, will adversely hurt its sales, earnings and cash flow.

Share Price Performance & Key Picks

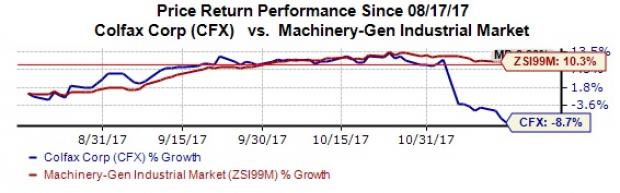

In the last three months, Colfax’s shares have lost 8.7%, underperforming 10.2% gain recorded by the industry.

Some stocks worth considering in the industry are Kadant Inc. (NYSE:KAI) , Sun Hydraulics Corporation (NASDAQ:SNHY) and Altra Industrial Motion Corporation (NASDAQ:AIMC) . While Kadant and Sun Hydraulics sport a Zacks Rank #1(Strong Buy), Altra Industrial Motion carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kadant pulled off an average positive earnings surprise of 20.32% over the last four quarters. Also, earnings estimates for 2017 and 2018 were revised upward in the last 60 days.

Sun Hydraulics delivered an average positive earnings surprise of 9.58% in the trailing four quarters. Also, bottom-line expectations for 2017 and 2018 improved over the past 60 days.

Altra Industrial Motion’s financial performance was impressive, with an average positive earnings surprise of 17.30% for the last four quarters. Also, earnings estimates for 2017 and 2018 were revised upward over the last 60 days.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Kadant Inc (KAI): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Colfax Corporation (CFX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.