- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cloudera's (CLDR) Q4 Earnings And Revenues Increase Y/Y

Shares of Cloudera, Inc (NYSE:CLDR) soared nearly 11% during the extended trading session on Mar 10 after the company reported better-than-expected fourth-quarter fiscal 2020 results. Additionally, optimistic outlook for first-quarter and fiscal 2021 also instilled investors’ confidence over the company’s growth prospects.

The enterprise data cloud company’s adjusted earnings of 4 cents per share compared favorably with the Zacks Consensus Estimate of a loss of 4 cents and the year-ago quarter’s loss of 15 cents as well. The robust bottom-line improvement was mainly driven by strong revenue growth and efficient cost management.

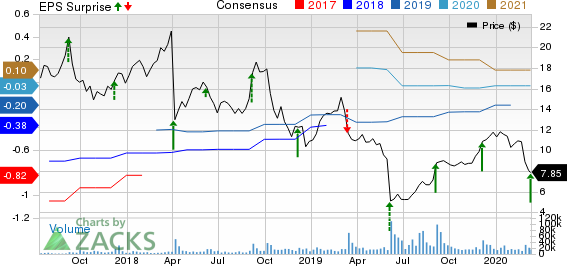

Cloudera, Inc. Price, Consensus and EPS Surprise

Quarter Details

Cloudera’s fourth-quarter revenues of $211.7 million topped the consensus mark by 5% and surged 46.5% year over year mainly driven by rapid adoption of its cloud-based products and services. The company added 27 net new customers during the quarter, who generate more than $100,000 of annualized recurring revenues (ARR). Adjusted annualized recurring revenues (ARR) were $731.2 million, up 11% year over year.

Segment-wise, subscription revenues (85.9% of revenues) jumped 47.9% year-over-year to $182 million. Moreover, services (14.1% of revenues) rallied 38.4% year over year to $29.8 million.

In the reported quarter, non-GAAP gross margin expanded 100 basis points (bps) to 79% on a year-over-year basis. Non-GAAP subscription gross margin was flat year over year at 88%. Non-GAAP services gross margin was 23% compared with the year-ago quarter’s figure of 16%.

While research and development (R&D) expenses rose 26.9% on a year-over-year basis to $67 million, sales and marketing (S&M) expenses surged 42.2% to $117.9 million. However, as percentage of revenues, R&D and S&M expenses declined 490 bps and 170 bps, respectively.

However, general and administrative (G&A) expenses soared 36.9% to $34.8 million. As a percentage of revenues, G&A was 16.4% compared with 38.1% in the year-ago quarter.

Loss from operations in fourth-quarter fiscal 2020 was $64.4 million, narrower than a loss of $87 million a year ago. However, on non-GAAP basis, the company reported operating income of $11 million compared with operating loss of $30.2 million.

Balance Sheet & Cash Flow

As of Jan 31, 2020, Cloudera had total cash, cash equivalents, marketable securities and restricted cash of $486.5 million compared with $502.2 million reported in the previous quarter.

Moreover, reported operating cash outflow of $9.4 million. This includes $16.1 million of payments related to the merger with Hortonworks.

Guidance

First-Quarter Fiscal 2021

Cloudera expects revenues between $202 million and $207 million. The Zacks Consensus Estimate for revenues is currently pegged at $203.8 million, which indicates year-over-year growth of 8.7%.

Subscription revenues are estimated between $180 million and $183 million.

Non-GAAP net earnings are expected between a loss of 1 cent to an earnings of 1 cent. The Zacks Consensus Estimate is pegged at a loss per share of 4 cents.

Fiscal 2021

Cloudera expects revenues between $860 million and $880 million. The Zacks Consensus Estimate for revenues is currently pegged at $854.1 million, which suggests year-over-year growth of 7.5%.

Subscription revenues are estimated between $750 million and $760 million.

Non-GAAP net earnings are expected between 25 cents to 29 cents, while Zacks Consensus Estimates a loss of 3 cents per share.

Zacks Rank & Stocks to Consider

Currently, Cloudera carries a Zacks Rank #3 (Hold).

Intel Corporation (NASDAQ:INTC) , Applied Materials, Inc. (NASDAQ:AMAT) and Garmin Ltd. (NASDAQ:GRMN) are some better-ranked stocks in the same industry. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Intel, Applied Materials and GRMN is currently pegged at 7.5%, 9.9% and 7.4%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Intel Corporation (INTC): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Cloudera, Inc. (CLDR): Free Stock Analysis Report

Original post

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.