- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Citigroup (C) Partners With Taskize, Eases Workflow Woes

Citigroup Inc (NYSE:C). C has joined forces with Taskize Limited for a strategic agreement to combine the latter’s structured workflow capabilities with Citigroup’s industry-leading proprietary custody network present in more than 60 markets. The partnership will create a network effect between Citigroup, its counterparts and other market infrastructures to enhance operational workflows.

Custody clients of Citi Securities Services can leverage Taskize’s query management platform to directly connect to their Citi Operations counterparts. With Taskize’s user interface and the creation of an end-to-end operational workflow experience through the partnership, the traditional email mechanism will no longer be required by custody clients to contact their respective counterparts. It will also provide real-time visibility on the status of an ongoing query and complete audit trail capabilities. Such features are likely to be crucial to address operational workflow challenges.

Jeffrey King, the global head of custody product development at Citigroup noted, “This partnership is based on a shared vision of secure inter-company workflows for query management and to move away from email chains between operational counterparts.” He also said, “By leveraging Taskize’s email management, flexible API integration and traceability on queries with fully auditable workflow, our custody clients will be able to gain greater insight into the status of their queries.”

Philip Slavin, CEO and co-founder of Taskize said, “We are delighted to be partnering with Citi, empowering them to service their clients in a secure, efficient and transparent way.”

This move by Citigroup reflects its commitment to offer innovative solutions to clients and mitigate risk. In fact, while streamlining costly counterparty workflows across buy-sides, sell-sides, custodians, market infrastructures and Fintech providers, Taskize’s platform ensures data sovereignty. Citigroup's custody clients will also be able to raise queries to all other institutions operating on the platform.

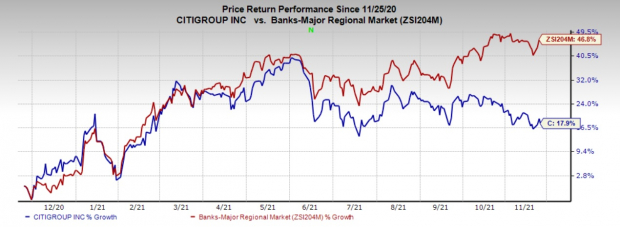

Over the past year, shares of Citigroup have gained 17.9% compared with 46.8% growth recorded by the industry.

Currently, Citigroup carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some better-ranked stocks in the banking space are Southern First Bancshares (NASDAQ:SFST) SFST, Colony Bankcorp, Inc. CBAN and Community Trust Bancorp CTBI. At present, Southern First sports a Zacks Rank #1, while Colony Bankcorp and Community Trust carry a Zacks Rank of 2 (Buy).

Over the past year, SFST stock has jumped 95.8%, whereas shares of CBAN and CTBI have gained 34.7% and 25.1%, respectively.

Over the past 30 days, the Zacks Consensus Estimate for Southern First’s current-year earnings has been revised 13.3% upward while that of Colony Bankcorp has been revised upward by 15.2%. Current-year earnings estimates for Community Trust have moved up marginally over the same time frame.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C): Free Stock Analysis Report

Community Trust Bancorp, Inc. (CTBI): Free Stock Analysis Report

Southern First Bancshares, Inc. (SFST): Free Stock Analysis Report

Colony Bankcorp, Inc. (CBAN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.