- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cisco (CSCO) Beats Q1 Earnings Estimates, Outlook Positive

Cisco Systems Inc. (NASDAQ:CSCO) reported first-quarter fiscal 2018 non-GAAP earnings of 61 cents per share beating the Zacks Consensus Estimate by a penny. However, the figure remained unchanged on a year-over-year basis. Acquisitions have negatively impacted earnings by a penny in the quarter.

Revenues declined 1.7% year over year to $12.14 billion and were almost in line with the Zacks Consensus Estimate. Acquisitions contributed 60 basis points (bps) to revenue growth in the quarter. Security and Applications revenues increased in the quarter.

Management provided positive top-line guidance for second-quarter fiscal 2018 based on order strength and improving traction of the subscription-based model.

Cisco noted that continuing transition to subscription-based model will continue to be a headwind. The negative impact is projected to increase from the current 1.5-2% to 2-3% in the upcoming years. However, management stated that the transition improves visibility, which bodes well for the company’s operations.

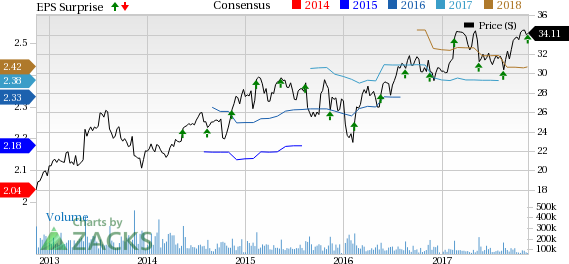

Cisco shares have returned 12.9% year to date, slightly outperforming the industry’s 11.4% rally.

Top-line Details

Products (74.6% of total revenues) declined 2.7% to $9.05 billion, while services (25.4% of total revenues) increased 1% to $3.08 billion. Almost 32% of the revenues were recurring in nature.

Revenues from subscriptions represent 52% of the company’s software revenues, which increased 18% from the year-ago quarter.

Geographically, on a year-over-year basis, revenues from both the Americas and APJC declined 1%. EMEA revenues declined 3% in the quarter. Total emerging markets declined 6% while the BRICs less Mexico went down 9%.

In terms of customer segments, enterprise declined 5%, while service provider dipped 6%. However, commercial and public sector rose 3% and 12%, respectively.

Total product orders inched up 1%. Americas, EMEA and APJC increased 1%, 2% and 1%, respectively.

Cisco realigned its reporting segments into five distinct categories — infrastructure platform, applications, security, services and other.

Routing, Switching Remain Weak

Infrastructure Platforms (57.4% of first-quarter revenues) comprise Switching, NGN routing, Wireless and Data Center solutions. Revenues declined 4% from the year-ago quarter to $6.97 billion.

The year-over-year decline was primarily due to sluggish routing revenues. This can be primarily attributed to continued weakness in service provider and a slowdown in enterprise routing business. Management expects enterprise routing to be weak due to SD-WAN architectural transition.

Switching revenues also declined modestly. However, the company witnessed strong demand for the intuitive network solution in the quarter.

Further, wireless revenues were strong and demand for the HyperFlex data-center solution was solid.

Management stated that the new subscription-based Catalyst 9000 switching platform has been adopted by more than 1,100 customers within a short span of time since its release. Moreover, results benefited from the continuing customer shift to 10 gig, 40 gig and 100 gig architectures. Additionally, rapid adoption of multi-cloud infrastructures was a key catalyst.

Cisco’s ACI solution is currently used by more than 4K customers. The company believes that ACI customers are benefiting from increased business agility due to network automation, simplified management and improved security features of the product.

AppDynamics Drive Growth

Applications (9.9% of revenues) consist of Collaboration portfolio of Unified Communications, Conferencing and TelePresence, Internet of Things (IoT) and application software businesses such as AppDynamics and Jasper.

Segment revenues increased 6% to $1.20 billion. Collaboration revenues rose modestly, with AppDynamics being the major contributor. Deferred revenues jumped 18%.

Security Remains Strong

Security (4.8% of revenues) climbed 8% to $585 million. The results were noticeable as deferred revenues surged 42% from the year-ago quarter.

The strong growth was driven by solid demand for unified threat, advanced threat and web security solutions.

Others

Other Products segment (2.4% of revenues) contains service provider video, cloud and system management and various emerging technology offerings. Revenues fell 16% to $296 million.

Services (25.4% of revenues) segment inched up 1% from the year-ago quarter to $3.08 billion. This was driven by growth in software and solutions services.

Acquisitions

During the quarter, Cisco completed the acquisition of Springpath, Viptela and Observable networks.

The company also announced the acquisition of privately held Perspica, a provider machine learning and data processing technology. The acquisition will enable Cisco’s customers to analyze large amounts of application-related data, in real time and with business context.

Recently, the company announced its plan to acquire BroadSoft for $1.9 billion.

Product Launches

During the quarter, Cisco unveiled its management and automation platform, Cisco Intersight. The platform is designed to be compatible with the company’s Unified Computing System (UCS) and HyperFlex Systems so that adoption related complexity can be avoided.

Moreover, Cisco recently launched a new portfolio of subscription offers called Business Critical and High Value Services powered by AI to predict future IT failures.

Operating Details

Non-GAAP gross margin contracted 150 bps from the year-ago quarter to 63.7%. The contraction was caused by lower product gross margin (down 180 bps), which was negatively impacted by higher memory prices (almost 130 bps).

As percentage of revenues, sales & marketing (S&M) expenses declined 30 bps. Research and development (R&D) expenses as well as general and administrative (G&A) expenses declined 40 bps and 10 bps, respectively.

Non-GAAP operating expenses, as percentage of revenues, increased 170 bps to 33.3%.

As a result, Non-GAAP operating margin contracted 320 bps to 30.4%. Acquisitions negatively impacted operating margin by 70 bps.

Balance Sheet and Cash Flow

Cisco exited the first-quarter with cash & cash equivalents and investments balance of almost $71.6 billion compared with $70.5 billion in the prior-year quarter. Cash & cash equivalents and investments available in the United States at the end of quarter were $2.5 billion.

Cisco repurchased approximately 51 million shares of common stock for an aggregate price of $1.62 billion. As of Oct 28, the remaining authorized amount under the current share repurchase program is approximately $10.1 billion.

Guidance

For second-quarter fiscal 2018, revenues are expected to rise 1-3% on a year-over-year basis. Non-GAAP earnings are anticipated between 58 and 60 cents per share.

The Zacks Consensus Estimate for earnings is pegged at 58 cents, while that for revenues is at $11.73 billion.

Gross margin is expected in the range of 62.5-63.5%, while operating margin is anticipated between 29.5% and 30.5% for the quarter.

Conclusion

We believe that Cisco’s expanding footprint in the rapidly growing security market looks promising. The company’s security solutions continue to add customers. Additionally, the company’s partnerships with Viacom (NASDAQ:VIAB) , Alphabet’s (NASDAQ:GOOGL) division Google and Alibaba (NYSE:BABA) will help Cisco gain significant traction in the cloud and IoT space in the long run.

However, weakness in the switching and routing is a headwind. Moreover, ongoing transition to subscription-based model will continue to hurt the top line. Further, weakness in the service provider business segment and intense competition from the likes of Huawei, Juniper and Arista Networks are other major concerns.

Cisco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Viacom Inc. (VIAB): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.