- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cincinnati Bell (CBB) Receives Wireless Backhaul Contract

Cincinnati Bell, Inc. (NYSE:CBB) is progressing with new business prospects and opportunities. The company reportedly received a 1,100-site wireless tower backhaul contract. The deal enables the company to be the backhaul service provider of almost all the towers in Cincinnati.

Small Cell & Backhaul

The telecom service provider confirmed that it has a contract to build 260 sites. The company, in collaboration with a larger carrier, has deployed around 230-235 small cell sites.

The company is in talks with other wireless operators for full-fledged 5G deployment. Teaming up with dark fiber partners will help in backhaul small cell densification projects. Dark fiber provides abundant bandwidth required for smooth functioning of wireless networks such as 4G and 5G. Dark fiber-based backhaul provides scalability and efficiency to bandwidth management. This will enable the company to significantly reduce backhaul costs.

Hawaiian Prospects

Meanwhile, Cincinnati Bell is also eyeing business opportunities with wireless backhaul and small-cell expansion in Hawaii. The company is also planning to expand fiber foothold in Hawaii.

Notably, Cincinnati Bell recently received the conditional approval from the Hawaii Department of Commerce and Consumer Affairs' (DCCA) Cable Television Division (CATV) for the buyout of Hawaiian Telecom Holdco, Inc. (NASDAQ:HCOM) . This marks a major progress in the deal closure process.

In November, the merger completed the Hart-Scott-Rodino Act review period. Hawaiian Telecom shareholders approved the proposed deal. The deal is currently under review by the Federal Communications Commission and the Public Utilities Commission of the State of Hawaii. The deal is expected to close as soon as all regulatory approvals and other customary closing conditions are met.

The merged entity is expected to provide high-speed, high-bandwidth fiber optic network while building a complementary IT solutions and cloud services business in Cincinnati and Hawaii.

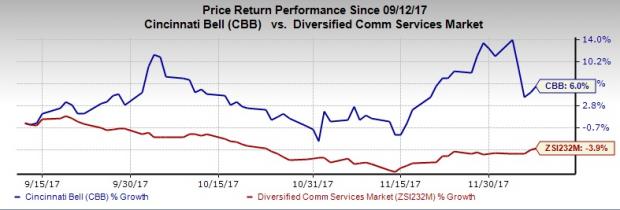

Zacks Rank & Price Performance

Cincinnati Bell currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past three months, the company’s shares have returned 6.0% against the industry’s decline of 3.9%.

Recent Deals

In October 2017, Cincinnati Bell completed the $201-million acquisition of OnX Enterprise Solutions. The takeover will help the company's transition to a hybrid IT-solutions provider.

In November 2017, CenturyLink Inc. (NYSE:CTL) finally completed the acquisition of Level 3 Communications amid regulatory approval from authorities and states.

In February 2017, Windstream Holdings, Inc. (NASDAQ:WIN) acquired EarthLink Holdings Corp. The deal witnessed the incorporation of 29,000 fiber-optic route miles from EarthLink, taking the total to 145,000 route miles.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Cincinnati Bell Inc (CBB): Free Stock Analysis Report

CenturyLink, Inc. (CTL): Free Stock Analysis Report

Windstream Holdings, Inc. (WIN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.