- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ciena's (CIEN) Q4 Earnings Miss Estimates, Revenues Beat

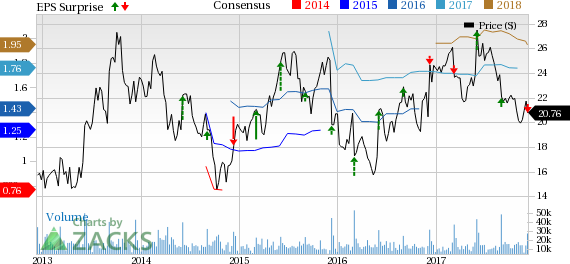

Ciena Corporation (NYSE:CIEN) reported fiscal fourth-quarter 2017 non-GAAP earnings of 46 cents, which increased 4.6% on a year-over-year basis but missed the Zacks Consensus Estimate of 50 cents.

Revenues of $744.4 million increased 3.95% year over year and beat the consensus mark of $738.1 million.

Although shares of Ciena have lost 15% of its value year to date, it fared better than the industry to which it belongs. The industry has declined 26.7% in the same time frame.

Segmental Details

Product revenues (82.8% of revenues) were up 5.8% year over year to $616.2 million. Services revenues (17.2% of revenues) declined 4.1% year over year to $128.2 million.

Segment-wise, networking platforms (80.5% of total revenue) grew 5.8% year over year to $598.9 million. The company’s stackable data center interconnect platform, WaveServer is trending well and it is expected to be a key growth driver going ahead.

The company believes that its newly launched 400 gig per wavelength chip, Wavelogic AI, which had a small contribution in the fourth quarter, will have a significant impact on its global sales going forward.

Fiber Deep technology represents a big opportunity for the company going forward driven by the strong adoption of its products among all major cable operators in the global market.

Revenues from Software and software-related services (5.6% of total revenue) rose 11.2% year over year to $41.8 million. The company's focus on migrating customers to Blue Planet network domain controller platform and increasing adoption of the Blue Planet analytics and orchestration platforms is a positive.

Global services revenues (13.9% of total revenue) declined 7.7% from the year-ago quarter to $103.7 million. The decline in deployment services in Caribbean and Latin America (CALA) and Brazil where the company had very large deployments in the last few years led to the year-over-year decline. However, on a sequential basis, it fared better.

Region-wise, Ciena’s revenues declined 4.9% in North America, 7.1% in CALA and 1.6% in Europe, the Middle East and Africa (EMEA), but soared 59.6% in Asia Pacific (APAC). Growth in APAC was fueled by India, which doubled sequentially. The company is very optimistic about the future prospects in the country.

U.S. customers accounted for 59.2% of its revenues, of which 27.6% was contributed by two major customers namely AT&T (NYSE:T) and Verizon.

However, the growth of these two major Tier 1 companies taken together is expected to remain flat or slightly down in the next year, which is a big concern.

Margins

The company’s non-GAAP gross margin contracted 100 basis points (bps) year over year to 44.2%.

Ciena incurred non-GAAP operating expenses of $240.9 million, up 3.7% from the year-ago quarter. However, as a percentage of revenues, it decreased 10 bps from the year-ago quarter to 32.4%.

Non-GAAP operating margin declined 90 bps to 11.9%.

Balance Sheet

The company ended the quarter with cash and investments of $919.6 million, compared with $854.2 million at the end of the previous quarter.

Ciena generated operating cash flow of $138.5 million in the quarter compared with approximately $136.7 million in the year-ago quarter.

Ciena announced its plan to repurchase up to $300 million of the company’s common stock through the end of fiscal 2020.

Guidance

Ciena also provided guidance for first-quarter fiscal 2018. Revenues for the current quarter are forecast in the range of $625–$655 million. Non-GAAP gross margin is anticipated to be approximately in the low to mid-40% range. Non-GAAP operating expenses are projected to be around $238 million.

The company expects overall annual revenue to grow in the range of 5-7% on an average over the next three years. Non-GAAP earnings are anticipated to grow in the range of 14-16% over the same time period.

Zacks Rank and Stocks to Consider

Ciena carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector include Intel Corporation (NASDAQ:INTC) , Lam Research Corporation (NASDAQ:LRCX) and NVIDIA Corporation (NASDAQ:NVDA) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for Intel, Lam Research and NVIDIA is projected to be 8.4%, 14.9% and 10.3%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Ciena Corporation (CIEN): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.