- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ciena (CIEN) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

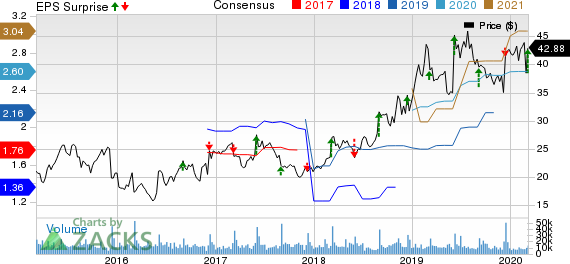

Ciena Corporation (NYSE:CIEN) reported healthy first-quarter fiscal 2020 results, wherein both the top and bottom lines surpassed the Zacks Consensus Estimate. Higher segmental revenues on the back of varied customer base, technology advancements and market share gains drove Ciena’s performance. In response to the results, the stock jumped 3%, closing at $42.88 on Mar 5.

Net Income

On a GAAP basis, net income in the quarter was $62.3 million or 40 cents per share compared with $33.6 million or 21 cents per share in the year-ago quarter. The year-over-year improvement was primarily driven by top-line growth.

Quarterly adjusted net income came in at $81.7 million or 52 cents per share compared with $52.8 million or 33 cents per share in the prior-year quarter. The bottom line surpassed the Zacks Consensus Estimate by 14 cents.

Ciena Corporation Price, Consensus and EPS Surprise

Revenues

Quarterly total revenues increased 7% year over year to $832.9 million on the back of higher segmental revenues and product sales. Ciena had two 10%-plus customers in the quarter, which represented 24% of revenues. The top line surpassed the consensus estimate of $822 million.

Region wise, revenues from the Americas were $574 million, up 11.2% year over year, driven by robust service provider business in North America, which includes new wins of two 10% customers — Verizon Communications Inc. (NYSE:VZ) and AT&T Inc. (NYSE:T) . Increased revenues from multiple system operators also leveraged the performance. Revenues from Europe, Middle East and Africa were $130 million, up 0.6% from $129.2 million in the year-ago quarter, driven by increased market share. Asia Pacific revenues totaled $128.9 million, down 3%, mainly due to the impact of COVID-19 in China.

Quarterly Segment Results

Revenues from Networking Platforms increased 6.2% year over year to $659 million, driven by new product launches. Platform Software and Services revenues were $51.9 million compared with $41.6 million in the prior-year quarter. Blue Planet Automation Software and Services revenues grew from $15 million to $15.5 million, primarily backed by two major wins from non-U.S. Tier 1 service providers. Revenues from Global Services were $106.5 million compared with $101.4 million a year ago.

Other Details

Adjusted gross margin was 45.1% compared with 42.2% in the year-ago quarter. Adjusted operating expenses were $266.4 million, up from $253.6 million. Adjusted operating income increased to $109.4 million from $74.6 million. Adjusted operating margin was 13.1% compared with 9.6% in the prior-year quarter. Adjusted EBITDA was $135.3 million, up from $96.2 million.

Cash Flow & Liquidity

In the first three months of fiscal 2020, Ciena generated $39.8 million of net cash from operating activities against $14.1 million of net cash utilization in the prior-year quarter. As of Jan 31, 2020, the company had $837.3 million in cash and equivalents with $680.8 million of net long-term debt. During the reported quarter, Ciena repurchased nearly 1.3 million shares for an aggregate price of $50.7 million.

Guidance

Ciena has provided outlook for second-quarter fiscal 2020 and full-year 2020. For the fiscal second quarter, revenues are expected to be in the range of $875-$905 million, which includes a reduction of nearly $30 million due to the projected impact of coronavirus. Adjusted gross margin is likely to be in the range of 42-44% with adjusted operating expense to be approximately $275 million.

For full-year 2020, revenues are anticipated to grow annually at a rate of 6-8%. Adjusted gross margin is likely to be in the band of 42-44%. Adjusted operating margin is estimated to be 15% with adjusted operating expense of $270-$275 million per quarter.

Zacks Rank & A Key Pick

Ciena currently has a Zacks Rank #3 (Hold).

A better-ranked stock in the broader industry is Telenav, Inc. (NYSE:T) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Telenav exceeded estimates twice in the trailing four quarters, the positive earnings surprise being 77.1%, on average.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>>

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Ciena Corporation (CIEN): Free Stock Analysis Report

Telenav, Inc. (TNAV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.