- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Chinese New Year Deadens European Open

Markets are quiet so far this morning with traders still digesting the various monetary policy announcements from around the world, in particular Europe and the UK, from last week. That being said the closure of many Asian markets to celebrate the Chinese Lunar New Year has made sure that the open today has been particularly calm. News over the weekend has also been sparse ahead of today’s Eurogroup meeting.

Those of you who joined me for Thursday’s webinar will have heard me talk about Cyprus and the potential problems that the lack of a bailout, or bail-in, could have on the rest of the Eurozone. A bailout seems to be ruled out as, although the amounts needed are miniscule in the grand scheme of things, the impact that would have on the country’s debt dynamics would be disastrous, prompting write-downs and bank losses.

The FT is reporting that a proposal of slashing the Cypriot banking sector alongside the bailing in of uninsured bank depositors, foreign bond holders would also be involved. This does risk further contagion, however, as it would likely prompt bank runs elsewhere in the Eurozone. The Eurogroup meeting today will see leaders discuss Cyprus and Greece.

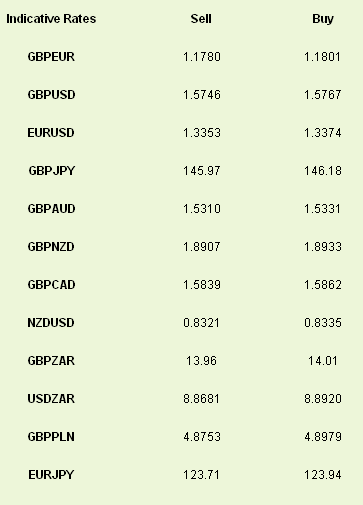

Price action has been muted so far this morning with EURUSD and GBPEUR trading sideways through the Asian session.

The Japanese yen has remained strong following comments on Friday that drove JPY off the highs. Fin Min Aso said that the “pace of the yen weakening had been too fast” and seemed to suggest that prices around 90-95 in USDJPY were what they were looking for. Ever the cynics we believe that the headlines reeked of a government looking to ease off the rhetoric so as to garner support at this weekend’s G20, in their dispute with China over the Senkaku Islands. Currency wars will nevertheless be high on the agenda also, you would think.

Related Articles

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

USD/CAD lifted by Trump’s tariff push but faces resistance overhead US data missing forecasts at the fastest pace in five months Fed rate cut bets grow, pushing Treasury yields...

The euro has gained ground on Tuesday. In the North American session, EUR/USD is trading at 1.0515, up 0.45%. On Monday, the euro climbed as high as 1.0527, its highest level this...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.