- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Children's Place (PLCE) Q3 Earnings & Sales Beat Estimates

The Children’s Place, Inc. (NASDAQ:PLCE) continued with upbeat performance in fiscal 2017 as it posted third-quarter results and also provided an encouraging outlook.

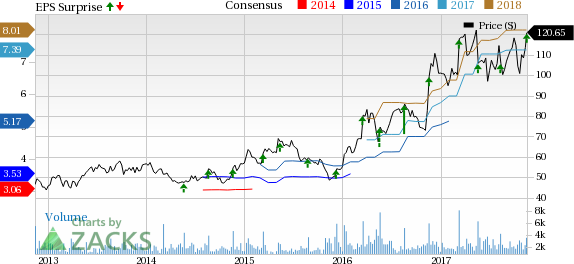

As a result, shares of the company rose 5.9% in the trading session on Nov 15. Year to date, this Zacks Rank #3 (Hold) stock has been up 19.6% comfortably outperforming the industry’s decline of 19.4%.

In the reported quarter, this pure-play children’s specialty apparel retailer posted adjusted earnings of $2.58 per share outpacing the Zacks Consensus Estimate of $2.46 and surged 12.7% from the year-ago period. Higher sales, margin expansion and share repurchase activity drove the bottom line.

Net sales came in at $490 million, up 3.4% year over year and also surpassed the Zacks Consensus Estimate of $477 million. Comparable store sales (comps) rose 5.1% in the quarter compared with 4.6% growth registered in the year-ago period. Notably, this was the eighth straight quarter of comps growth. Though U.S. comp grew 5.9%, Canada comp declined 1.2%.

Adjusted gross profit increased 4.1% to $202.4 million while adjusted gross margin improved 30 basis points to 41.3% on account of improved merchandise margin. Adjusted operating income rose 9.5% to $68.4 million while operating margin expanded 80 basis points to 14%.

Store Update

In the quarter under review, Children’s Place opened one outlet but did not shutter any stores bringing the total count to 1,027 stores. Since the announcement of fleet optimization strategy in 2013, the company had closed 156 stores.

During fiscal 2017, the company plans to open two and shutter approximately 25-30 stores.

Per Children’s Place, its international franchise partners opened 10 points of distribution and closed three. At the end of the quarter, there were 168 international points of distribution operated by seven franchise partners in 19 countries. The company believes that there is ample opportunity to take the count to more than 300 points of distribution by the end of 2020.

Gill Capital, the company’s new franchise partner, will open five stores in Indonesia on November 18 with plans to open 25 outlets over a period.

Other Financial Aspects

Children’s Place ended the quarter with cash and cash equivalents of $257.7 million, revolving loan of $56.4 million and shareholders’ equity of $510.5 million. For fiscal 2017, the company projects capital expenditures of approximately $65 million.

Furthermore, the company bought back shares worth roughly $28 million and paid quarterly dividend of approximately $7 million. Since 2009, Children’s Place has returned more than $863 million via share repurchases and dividends.

Encouraging View

Management now envisions fiscal 2017 adjusted earnings in the range of $7.46-$7.51, up from $7.23 to $7.33 per share, projected earlier. For the fourth quarter, earnings are expected to come within the range of $2.07-$2.12 per share.

Net sales are expected to be in the band of $1.835-$1.845 billion, including the 53rd week during fiscal 2017. It forecasts low-single digit increase in comparable retail sales for the final quarter.

Looking for More? Check These 3 Trending Retail Stocks

Big Lots, Inc. (NYSE:BIG) delivered an average positive earnings surprise of 81.1% in the trailing four quarters. The company has a long-term earnings growth rate of 13.5% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar Tree, Inc. (NASDAQ:DLTR) has a long-term earnings growth rate of 13.2% and carries a Zacks Rank #2.

Ross Stores, Inc. (NASDAQ:ROST) pulled off an average positive earnings surprise of 6.3% in the trailing four quarters. It has a long-term earnings growth rate of 10% and carries a Zacks Rank #2.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.