- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Chicago Bridge & Iron, McDermott Sign $6B Merger Deal

Chicago Bridge & Iron Company (NYSE:CBI) and McDermott (NYSE:MDR) have agreed to merge in an all-stock deal worth about $6 billion, creating an extensive engineering, procurement, construction and installation company amid a stabilizing global oil market, with $10 billion in combined revenues and an impressive backlog of $14.5 billion. The deal is expected to conclude in the second quarter of 2018.

Per the terms of the deal, McDermott’s shareholders will own 53% of the new, combined company, while Chicago Bridge & Iron shareholders would own the remainder. The shareholders would receive 2.47 McDermott shares for each Chicago Bridge & Iron share owned, or 0.82407 shares if McDermott initiates a planned three-to-one reverse stock split prior to the conclusion of the deal.

The deal is expected to be cash-accretive (excluding one-time costs) within the first year after it is concluded. Both companies expect to generate annualized cost synergies of $250 million in 2019 and sizeable revenue synergies. This is in addition to Chicago Bridge & Iron’s $100-million cost-reduction program.

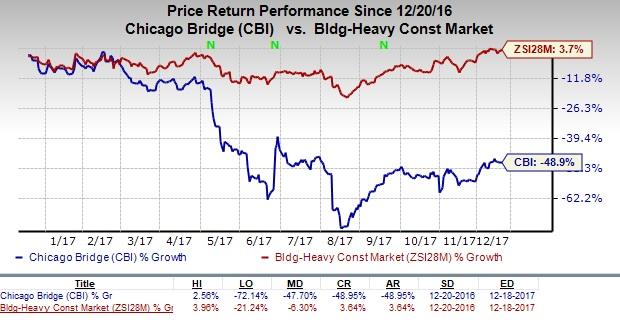

This Zacks Rank #3 (Hold) company’s shares have lost 49% of value in the past year, in stark contrast to the industry’s gain of 3.7%. The company has missed the Zacks Consensus Estimate for earnings by an average of 149.7% over the trailing four quarters, and also lagged revenue estimates during the same time frame. The company has been plagued by formidable headwinds since the crash in oil prices and has taken aggressive measures to shore up its finances.

Chicago Bridge & Iron also intends to sell its crown jewel Technology licensing business, and implement a comprehensive corporate and operating cost-reduction program. With slumping revenues, bleak guidance, distress sale of a key operating unit and the need for extreme strategic action, the future looked exceedingly uncertain for Chicago Bridge & Iron.

McDermott, on the other hand, has benefited from a flurry of contract wins in the Middle East, including from Saudi Aramco. The opportunity to merge with McDermott came when Chicago Bridge & Iron pursued the sale of its Technology and former Engineered Products businesses. The deal includes the technology business.

The combined company will be completely vertically integrated, and offer end-to-end engineering, procurement, construction and installation (EPCI) services to the onshore and offshore energy sectors.

McDermott primarily focuses on offshore operations, while Chicago Bridge & Iron's strength is in onshore projects. The deal will, thus, integrate two highly complementary businesses and create a leading onshore-offshore EPCI company, with immense scale and diversification to capitalize on global growth opportunities.

Stocks to Consider

Some better-ranked companies working in the same space as Chicago Bridge & Iron are MasTec, Inc. (NYSE:MTZ) and EMCOR Group, Inc. (NYSE:EME) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

With four back-to-back, robust earnings beats, MasTec has a striking average positive surprise of 28.1%.

EMCOR Group has a strong earnings beat history, having surpassed estimates thrice over the trailing four quarters. It has a positive average surprise of 17%.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Chicago Bridge & Iron Company N.V. (CBI): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

McDermott International, Inc. (MDR): Free Stock Analysis Report

Original post

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.