- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Chevron Unveils $18.3B Capital Expenditure Budget For 2018

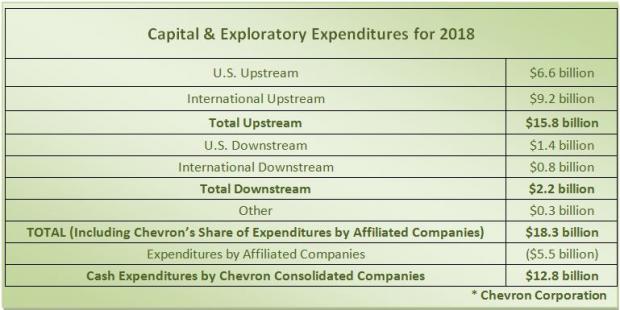

Chevron Corporation (NYSE:CVX) recently announced its capital and exploratory spending program for 2018. Budget for capital projects is reserved at $18.3 billion, lower than this year’s estimate of $19.8 billion. Per the company, capital spending for the next three years will be in the range of $17-$22 billion per annum. Of the total budget for 2018, $5.5 billion is meant for affiliated companies' expenses.

The overall 2018 budget is 4% lower than the one provided for 2017. It has been declining for the last four years. Per the company, it is focusing on growth projects, which will add to the company's cash flow in the next two years, including the Permian Basin assets. Completion of several projects and enhanced efficiencies in the company’s operations were also responsible for the lowered budget for 2018.

The company however expects production to grow in the coming year driven by its Permian Basin play. To sustain the current producing assets, the company will bear costs of around $8.7 billion, of which $3.3 billion will be utilized for the Permian Basin. Per Chevron, $1.0 billion will be used for other shale and tight rock investments. The company's assets in the Tengiz field of Kazakhstan were allotted $3.7 billion while the downstream projects were allotted $2.2 billion.

About the Company

San Ramon, CA-based Chevron is one of the largest publicly traded oil and gas companies in the world, based on proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals, and other energy-related businesses. The company divides its operations into two main segments: Upstream and Downstream.

In the third quarter, Chevron generated $5.4 billion in operating cash flow, while shelling out around $5.2 billion in capital expenditures and dividends. This led to around $200 million in excess cash flows - something the company achieved for the first time since 2012. Going forward, we expect Chevron's free cash flow to improve significantly given the company's initiatives to reduce costs, exit unprofitable markets and streamline the organization.

However, we remain concerned about the challenges faced by Chevron's U.S. production. The company produced 681 thousand oil-equivalent barrels per day in the third quarter, down 2.4% year over year and 2.9% sequentially. The poor performance of the region – despite output increases in the Gulf of Mexico and the Permian basin – could be attributed to asset sales and natural field declines in other areas.

Chevron has gained 1.6% year to date compared with 3.4% growth of its industry.

Zacks Rank and Stocks to Consider

Chevron has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector include ConocoPhillips (NYSE:COP) , Northern Oil and Gas, Inc. (NYSE:NOG) and Holly Energy Partners, L.P. (NYSE:HEP) . All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based ConocoPhillips is a major global exploration and production company. The company’s sales for 2017 are expected to increase 24.4% year over year. The company delivered an average positive earnings surprise of 152.3% in the last four quarters.

Minnetonka, MN-based Northern Oil and Gas is an independent energy company. The company’s sales for the fourth quarter of 2017 are expected to increase 51.9% year over year. The company delivered an average positive earnings surprise of 175% in the last four quarters.

Dallas, TX-based Holly Energy is a production pipeline company. The company’s sales for 2017 are expected to increase 10.4% year over year. The company delivered a positive earnings surprise of 57.1% in the third quarter of 2017.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Chevron Corporation (CVX): Free Stock Analysis Report

Holly Energy Partners, L.P. (HEP): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.