- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Charles River (CRAI) Appoints New Chief Financial Officer

CRA International, Inc. that conducts business as Charles River Associates (NASDAQ:CRAI) yesterday announced that it has appointed Daniel K. Mahoney as chief financial officer effective Mar 30, 2020. Mahoney will replace Chad Holmes, who will be the company’s executive vice president and chief corporate development officer.

Mahoney has around 20 years of financial leadership experience. Before joining CRA, he worked with BrightSphere Investment Group serving as senior vice president and head of finance. He also has experience of working with PricewaterhouseCoopers and State Street (NYSE:STT) Global Advisors.

Paul Maleh, CRA’s chief executive officer and president stated that, “We believe his depth of public company accounting and financial leadership experience makes him the right choice to lead CRA as our Chief Financial Officer as we continue to grow our organization,".

We believe that Mahoney’s appointment will further enhance the quality of the professional team that has helped Charles River achieve and maintain a solid reputation of providing high-quality consulting services.

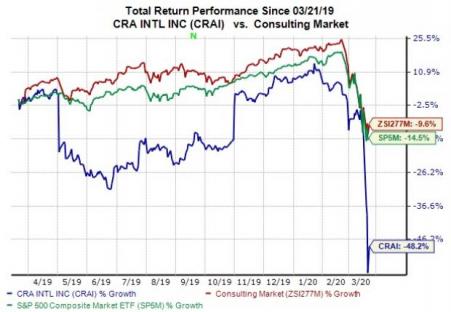

Notably, shares of CRA have decreased 48.2% over the past year compared with 9.6% decline of the industry it belongs to and 14.5% fall of the Zacks S&P 500 composite.

Zacks Rank & Other Stocks to Consider

CRA currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader Zacks Business Services sector are Sykes Enterprises (NASDAQ:SYKE) , Omnicom (NYSE:OMC) and Genpact (NYSE:G) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term expected EPS (three to five years) growth rate for Sykes, Omnicom and Genpact is pegged at 10%, 5.6% and 14%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Charles River Associates (CRAI): Free Stock Analysis Report

Omnicom Group Inc. (OMC): Free Stock Analysis Report

Sykes Enterprises, Incorporated (SYKE): Free Stock Analysis Report

Genpact Limited (G): Free Stock Analysis Report

Original post

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.