- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CF Industries (CF) To Report Q4 Earnings: What's In The Offing?

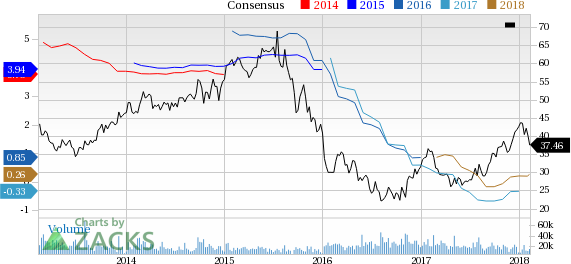

CF Industries Holdings, Inc. (NYSE:CF) is set to release fourth-quarter 2017 results after the closing bell on Feb 14.

The fertilizer maker’s adjusted loss for the third quarter was at 39 cents per share, narrower than the Zacks Consensus Estimate of a loss of 55 cents.

Net sales increased roughly 28% year over year to $870 million in the quarter. The figure also topped the Zacks Consensus Estimate of $723 million.

CF Industries beat the Zacks Consensus Estimate in two of the trailing four quarters, while missing in the other two with an average negative surprise of 85.1%.

CF Industries has outperformed the industry it belongs to over the last six months. The company’s shares have gained around 17.5% over this period, compared with roughly 14% gain recorded by the industry.

Let’s see how things are shaping up for this announcement.

Factors at Play

In November 2017, CF Industries noted that the third quarter witnessed a rapid increase in the global price of urea from the second quarter, which was driven by considerably lower Chinese exports, higher production and energy costs, a weaker dollar and strong global demand. The company expects lower Chinese urea export volumes to continue and volatility in nitrogen prices in global markets to continue through 2018.

The company also noted that it expects improved volumes and higher nitrogen prices across all products on a year over year comparison basis for the fourth quarter of 2017. CF Industries gained from higher sales volume across all segments in the third quarter.

CF Industries is likely to benefit from higher nitrogen demand. During the last reported quarter, Brazil was major purchaser of nitrogen and India issued three tenders, which resulted in purchase of 1.4 million metric tons urea.

The company expects a consistent global nitrogen demand growth, which should be partly driven by rising global population and industrial growth on the back of increased adoption of emission control, recovering mining sector and synthetic nitrogen products.

CF Industries witnessed lower year over year pricing across its Ammonia, Granular Urea and Urea Ammonium Nitrate (UAN) units in the third quarter due to higher nitrogen supply. However, the company is expected to benefit from improved pricing in the December quarter.

CF Industries should also benefit from cost efficiencies in the to-be-reported quarter. It should also gain from its efforts to boost production capacity. Volumes in the company’s Ammonia unit surged around 64% year over year in the last reported quarter owing to additional production volumes from the new capacity expansions at Donaldsonville and Port Neal complexes. Moreover, volumes increased roughly 42% in the Granular Urea segment, driven by additional volume available from the new urea capacity at the Port Neal nitrogen complex.

The Zacks Consensus Estimate for revenues for CF Industries for the to-be-reported quarter stands at $1,039 million, reflecting an increase of 19.9% from the year-ago quarter and a 19.4% rise from the sequentially prior quarter.

The Zacks Consensus Estimate for average selling prices for the company’s Ammonia unit for the fourth quarter stands at $293 per ton, reflecting an expected increase of 5.8% from the year-ago quarter. The Zacks Consensus Estimate for the Granular Urea segment stands at $241 per ton, representing an expected 12.6% year over year increase.

Moreover, average selling price for the UAN unit is expected to rise 6% year over year as the Zacks Consensus Estimate stands at $158 per ton. The Zacks Consensus Estimate for the Ammonium Nitrate (AN) unit stands at $208 per ton, representing an expected 20.9% year over year increase.

With respect to volumes, ammonia sales volumes are projected to witness a 6.8% year-over-year rise in the fourth quarter as the Zacks Consensus Estimate is pegged at roughly 0.8 million tons. The Zacks Consensus Estimate for granular urea sales volume is pegged at 1.1 million tons, reflecting a 29.2% year over year rise. UAN sales volume is expected to dip 10.5% year over year as the Zacks Consensus Estimate stands at 1.8 million tons. Moreover, the Zacks Consensus Estimate for sales volume for the AN unit is 562,000 tons, reflecting a 3.9% year over year rise.

Earnings Whispers

Our proven model does not conclusively show that CF Industries is likely to beat the Zacks Consensus Estimate this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below:

Zacks ESP: The Earnings ESP for CF Industries is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate stand at a loss of 11 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: CF Industries currently carries a Zacks Rank #3, which when combined with a 0.00% ESP, makes surprise prediction difficult.

Note that we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Other Stocks to Consider

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

The Mosaic Company (NYSE:MOS) has an Earnings ESP of +4.72% and a Zacks Rank #1.

Huntsman Corporation (NYSE:HUN) has an Earnings ESP of +3.27% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle Mines Limited (NYSE:AEM) has an Earnings ESP of +5.76% and carries a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Huntsman Corporation (HUN): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Mosaic Company (The) (MOS): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.