- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Celldex (CLDX) Q4 Loss Narrows, Revenues Beat, Shares Up

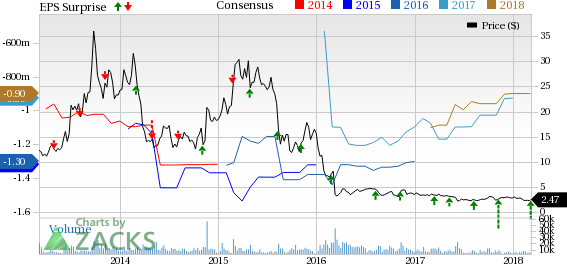

Celldex Therapeutics, Inc. (NASDAQ:CLDX) has incurred fourth-quarter 2017 loss (excluding income tax benefit of $19.1 million) of 17 cents per share, narrower than both the Zacks Consensus Estimate of a loss of 23 cents as well as the year-ago loss of 30 cents. Lower costs and higher revenues led to this upside.

Total revenues in the quarter soared 84.4% year over year to $3.5 million, beating the Zacks Consensus Estimate of $1.91 million. The manufacturing service agreement with the International AIDS Vaccine Initiative drove the top line.

Shares of the company rose 2% in after-hours trading on Mar 7.

However, the stock has not done too well in the past year. Shares of the company have underperformed its industry, having declined 28.4% compared with the industry’s 3.9% decrease.

Quarterly Details

Research and development expenses declined 4.5% from the year-ago period to $23.5 million. General and administrative spend improved 50.6% to $5.9 million.

As of Dec 31, 2017, Celldex had cash, cash equivalents and marketable securities of $139.4 million compared with $140.5 million as of Sep 30, 2017. The biotech company’s weakened cash position was due to higher operating expense, partially offset by net proceeds raised from sales of its common stock this month under the contract with Cantor.

2017 Results

Total revenues for the year surged 87.8% to $12.7 million, higher than the Zacks Consensus Estimate of $10.57 million.

Net loss for 2017 (excluding income tax benefit of $24.3 million) came in at 91 cents per share, slightly wider than the Zacks Consensus Estimate of 90 cents. However, the company had reported $1.27 of loss a year ago.

2018 Outlook

Celldex expects that its cash position as of December 2017-end plus $6.1 million in net proceeds generated from the sale of its common stock in the last two months and the anticipated proceeds from any future sales of common stock under the agreement with Cantor will be adequate to fund the working capital requirements as well as the planned operations through 2018.

Pipeline Update

Celldex’s most advanced pipeline candidate is antibody drug conjugate, glembatumumab vedotin, currently under evaluation for the treatment of triple negative breast cancer (phase IIb METRIC study) and metastatic melanoma (phase II). Enrolment in the key METRIC study was completed in August 2017 with top-line data expected in the second quarter of 2018. The company also plans to file a biologics license application in the second half of 2019.

In the melanoma study, Celldex added a fourth cohort, a glembatumumab plus CDX-301 arm. The combination will be studied on patients with failed prior checkpoint therapy.

Apart from glembatumumab vedotin, promising candidates in the company’s pipeline include varlilumab, CDX-3379 and CDX-014.

In January 2018, the company closed enrollment for phase II trial, evaluating varlilumab with Bristol-Myers’ (NYSE:BMY) Opdivo including cohorts in five indications namely colorectal cancer, ovarian cancer, head and neck squamous cell carcinoma, renal cell carcinoma and glioblastoma.

Celldex expanded its phase I study in January, assessing CDX-014 in advanced renal cell carcinoma to include patients with ovarian clear cell carcinoma.

In November 2017, the company initiated a phase II program on CDX-3379 in combination with Eli Lilly’s (NYSE:LLY) Erbitux in patients with head and neck squamous cell carcinoma, having developed resistance to Erbitux.

The company also commenced a phase I study in the same month to evaluate CDX-014 for treating locally advanced or metastatic solid tumors

Zacks Rank & Stock to Consider

Celldex carries a Zacks Rank #3 (Hold). A better-ranked stock in the health care sector is Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates have moved up from $3.78 to $4.15 for 2018 over the last 30 days. The company pulled off positive surprises in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has climbed 53.4% over a year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Celldex Therapeutics, Inc. (CLDX): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.