- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Celldex (CLDX) Q3 Loss Narrows, Revenues Beat, Shares Up

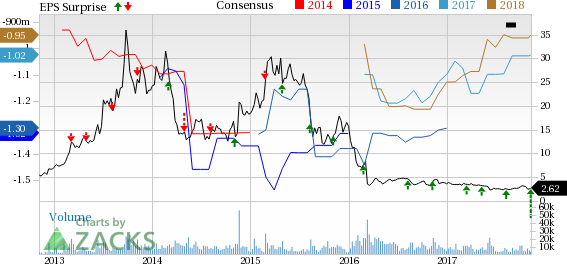

Celldex Therapeutics, Inc. (NASDAQ:CLDX) incurred third-quarter 2017 loss (adjusted for one-time items) of 14 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 24 cents as well as the year-ago loss of 29 cents per share. Lower costs and higher revenues led to the narrower loss in the quarter.

Total revenue in the quarter rose 77.3% year over year to $3.9 million, beating the Zacks Consensus Estimate of $1.17 million. The manufacturing service agreement with the International AIDS Vaccine Initiative led to higher revenues in the quarter.

Shares of the biotech company rose 10% in after-hours trading on Tuesday.

However, the stock has not done too well this year so far. It has declined 26% year to date against the 3.3% increase registered by the industry.

Research and development expenses declined 12.4% from the year-ago period to $21.9 million due to lower varlilumab contract manufacturing and clinical studies expenses. General and administrative spend declined 4.3% to $5.3 million due to lower commercial planning costs and stock-based compensation expenses.

As of Sep 30, 2017, Celldex had cash, cash equivalents and marketable securities of $140.5 million compared with $154.0 million as of Jun 30, 2017. Celldex expects that this cash plus $11.3 million in net proceeds raised from sales of its common stock this month under the agreement with Cantor will be enough to fund working capital requirements and planned operations through 2018.

Pipeline Update

Celldex’s most advanced pipeline candidate is antibody drug conjugate, glembatumumab vedotin, currently being evaluated for the treatment of triple negative breast cancer (phase IIb—METRIC study) and metastatic melanoma (phase II). Enrolment in the key METRIC study closed this August, with data expected in the second quarter of 2018. In the melanoma study, Celldex added two new cohorts, a glembatumumab plus varlilumab arm and a glembatumumab plus checkpoint inhibitor arm, including either Bristol-Myers’ (NYSE:BMY) Opdivo or Merck’s (NYSE:MRK) Keytruda.

Apart from glembatumumab vedotin, other promising candidates in its pipeline, include varlilumab and CDX-014 (phase I—advanced renal cell carcinoma) among others.

Varlilumab is being evaluated in combination with Opdivo in a phase II study that includes cohorts in five indications—colorectal cancer, ovarian cancer, head and neck squamous cell carcinoma, renal cell carcinoma and glioblastoma. Celldex plans to complete enrolment across all cohorts in the phase II portion of the study in the first quarter of 2018.

Along with the earnings release, Celldex announced data from a phase II study evaluating a combination of glembatumumab vedotin and varlilumab in melanoma patients who have progressed on checkpoint inhibitors. Of the 31 eligible patients only one had a confirmed partial response. Another two patients had partial response at a single timepoint. The median progression-free survival was 2.6 months, with 52% of patients having stable disease for six weeks or more. The full data set will be presented at the Society for Immunotherapy of Cancer (SITC) annual meeting this week.

With the Kolltan acquisition in Nov 2016, Celldex gained rights to two of Kolltan’s cancer pipeline candidates, CDX-0158 and CDX-3379. While CDX-0158 is being evaluated in a phase I study for refractory gastrointestinal stromal tumors/GIST and other KIT positive tumors, a phase II study on CDX-3379 in patients with recurrent/metastatic head and neck squamous cell cancer who are refractory to Eli Lilly (NYSE:LLY) /Bristol-Myers’ Erbitux is expected to be initiated by year end.

Celldex carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Celldex Therapeutics, Inc. (CLDX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.