- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Celgene CAR-T Therapy Gets Breakthrough Therapy Designation

Celgene Corporation (NASDAQ:CELG) and partner bluebird bio, Inc. (NASDAQ:BLUE) announced that their chimeric antigen receptor T-cell (CAR-T) therapy candidate, bb2121 targeting b-cell maturation antigen (BCMA) in previously treated patients with multiple myeloma obtained Breakthrough Therapy Designation from the FDA.

The candidate was also granted PRIority MEdicines (PRIME) eligibility by the European Medicines Agency (EMA).

Breakthrough Therapy Designation is intended to expedite the development and review of drugs that are intended to treat serious or life-threatening conditions while PRIME is a program launched by the EMA to enhance support for the development of medicines that target an unmet medical need.

We remind investors that Celgene entered into a collaboration agreement with bluebird bio in March 2013 to develop CAR-T cell therapies. The collaboration was amended and restated to focus on developing product candidates targeting B-cell maturation antigen (BCMA) in June 2015. The lead candidate in this program is bb2121, anti-BCMA CAR-T program is currently being studied in a phase I trial for the treatment of relapsed/refractory multiple myeloma. Both companies are also developing a second anti-BCMA CAR-T program, bb21217.

CAR-T uses patient’s cells to identify and destroy cancer cells, thereby making it different from other small molecule or biologic therapies. During the treatment, T cells are drawn from a patient's blood. These cells are then reprogrammed in the manufacturing facility to create genetically coded cells to express a chimeric antigen receptor to recognize and fight cancer cells and other B cells expressing a specific antigen.

The therapy has been in spotlight in 2017. Novartis AG's (NYSE:NVS) Kymriah was the first CAR-T to get FDA approval in September 2017. Last month, Gilead Sciences, Inc. (NASDAQ:GILD) also received FDA’s approval for Yescarta (axicabtagene ciloleucel), for the treatment of refractory aggressive non-Hodgkin lymphoma, which includes DLBCL, transformed follicular lymphoma and primary mediastinal B-cell lymphoma.

While the long-term impact of the treatment is yet to be evaluated, the approval opens up new frontiers in the treatment of cancer.

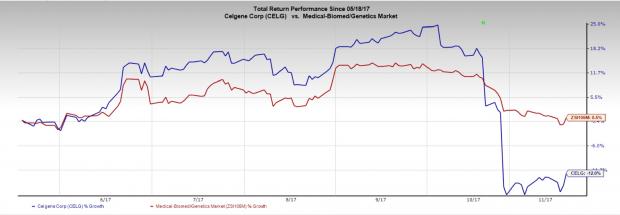

Meanwhile, Celgene’s stock has fallen 12% in the last six months as against the industry’s gain of 0.5%.

Celgene’s third-quarter results were mixed with the company beating earnings but missing sales estimates. While Revlimid sales were impressive yet again, Otezla sales in the United States were weak which led the management to reduce annual guidance for the drug.

Zacks Rank

Celgene is a Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Novartis AG (NVS): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

bluebird bio, Inc. (BLUE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

US index futures broke lower after Marvell Technology's earnings missed. Nasdaq and S&P 500 are now testing key support zones. Meanwhile, Amazon, Oracle, Tesla and...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.