- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Caterpillar (CAT) Rides On Strong End Markets & Cost Control

On Dec 18, we issued an updated research report on the mining and equipment behemoth, Caterpillar Inc. (NYSE:CAT) . The mining and equipment behemoth has delivered a turnaround performance this year owing to its relentless cost saving actions. The improvement also continues to be driven by the Asia-Pacific region and the construction sector. Notably, the Resource Industries has also picked up lately.

Caterpillar delivered another upbeat quarter with adjusted earnings per share surging 129% in the third quarter while revenues improved 24.6%, further building on the momentum noted in the first half of 2017. The better-than-expected performance can be attributed to surprisingly strong demand for construction equipment in North America, robust sales in China, improvement in other markets as well as disciplined cost-control efforts. Moreover, Caterpillar’s backlog was at $15.8 billion at the end of quarter, a year-over year improvement of $3.8 billion.

The company reported a rise of 26% in global retail sales for the three months ended November 2017, with improvement noted across all regions — its best performance so far in 2017. Within Machines, Resource Industries and Construction Industries reported positive gains for the fifth and tenth consecutive month, respectively, and scaled peak levels for 2017. Energy & Transportation’s retail sales improved for the third consecutive month. The company’s overall retail sales growth graph has remained in the positive territory since March this year. The company witnessed a 1% rise in machine retail sales in March, which put an end to its unprecedented 51-month long stretch of declining sales. The company has delivered an average sales growth of 11% since March.

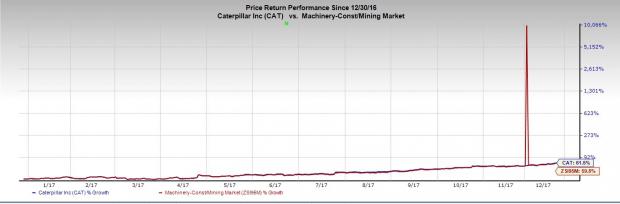

Given the performance so far, the company has outperformed the industry on a year-to-date basis. Shares have surged 61.5% while the industry registered growth of 59.8%. The stock has an estimated long-term earnings growth rate of 10.33%.

Caterpillar to Finish 2017 on a Strong Note

Owing to encouraging order rates, upbeat economic indicators and an increasing backlog, Caterpillar hiked revenue guidance during third-quarter conference call to the range of $44 billion from the prior range of $42-$44 billion. The company now projects earnings per share of $6.25 compared with previous guidance of $5.00 per share. The mid-point of the revenues and earnings guidance reflects year-over-year growth of 14% and 83%, respectively.

The Zacks Consensus Estimate for 2017 for revenues is at $44.52 billion and for earnings at $6.44, both ahead of the company's guidance. Estimates for Caterpillar have moved up in the past 30 days, reflecting the optimistic outlook of analysts. The earnings estimate for fiscal 2017 has gone up 22% while that of fiscal 2018 has moved north 15%.

Will the Momentum Sustain in 2018?

Caterpillar’s share price has benefited since the victory of Donald Trump as investors expect Trump’s plans of big spending in infrastructure to boost revenues which had until that point borne the brunt of weak mining demand. The prospect of gigantic infrastructure spending is welcome news for Caterpillar which is anticipated to play a major role in the national infrastructure plan.

Meanwhile, the Construction Industries segment is benefiting from strong order activity across all regions and favorable price realization. End-user demand remains robust in North America, driven by an uptick in pipeline construction and improved residential and non-residential construction. In China, the construction industry is improving due to government spending. In 2017, the 10-ton-and-above excavator industry in China is projected to more than double from last year. Not only China, but also other regions in the Asia Pacific are anticipated to show improvement in construction activity going forward. In Resource Industries, sales are being driven by continued strong demand for aftermarket parts, favorable changes to dealer inventories, and positive pricing.

In September 2015, Caterpillar set upon significant restructuring and cost reduction initiative, with actions expected through 2018. Once fully implemented, the plan would aid to lower its annual operating costs by about $1.5 billion. This is likely to stem from the consolidation or closure of more than 30 facilities that would decrease manufacturing square footage by more than 10% and reduce the workforce by more than 10,000 people. In addition to restructuring activities, Caterpillar continues to focus on customers and on the future by continuing to invest in digital capabilities, connecting assets and jobsites along with developing the next generation of more productive and efficient products.

Caterpillar currently sports a Zacks Rank #1 (Strong Buy).

Other top-ranked companies in the industrial product space include Deere & Company (NYSE:DE) , H&E Equipment Services, Inc. (NASDAQ:HEES) and Terex Corporation (NYSE:TEX) . All these stocks flaunt the same Zacks rank as Caterpillar. You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company has an expected long-term growth of 8.2%. Its shares have surged 49.5%, year to date.

H&E Equipment Services has expected long-term growth of 15.55%. It shares have gone rallied 70.9%, year to date.

Terex has expected long-term growth of 11.25%. Since the beginning of the year, its shares have gone up 49.8%.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.