- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Casey's (CASY) Q3 Earnings Surpass Estimates, Decline Y/Y

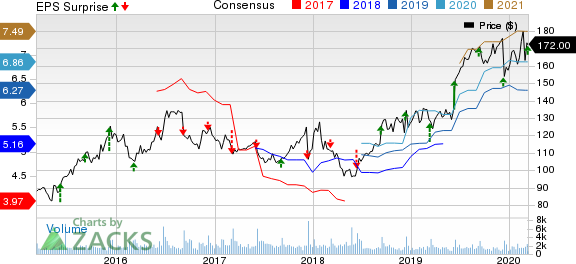

Casey's General Stores, Inc.’s (NASDAQ:CASY) third-quarter fiscal 2020 marked the seventh straight quarter of a positive earnings surprise. However, the bottom line declined on a year-over-year basis. The top line fell short of the Zacks Consensus Estimate for the second quarter in row but increased from a year ago. Notably, this IA-based company retained fiscal 2020 same-store sales projection for Fuel, Grocery and Other Merchandise, and Prepared Food & Fountain categories.

Management highlighted that an unfavorable pricing environment compared with the year-ago period resulted in lower growth in fuel gross profit dollars. Nevertheless, it is optimistic about the January launch of the Casey's Rewards program.

Shares of this Zacks Rank #3 (Hold) company have gained 9.6% compared with the industry’s rally of 10.8% in the past three months.

A Closer Look at Q3 Results

Casey's reported quarterly earnings of 91 cents a share that surpassed the Zacks Consensus Estimate of 87 cents but declined 19.5% from $1.13 in the year-ago period.

Total revenues of $2,248.2 million rose 9.8% year over year but missed the Zacks Consensus Estimate of $2,290 million. We note that revenues at Fuel, Grocery & Other Merchandise and Prepared Food & Fountain categories witnessed growth.

Gross profit came in at $496.9 million, up 5.7% year over year, while gross margin contracted 90 bps to 22.1%.

Casey's witnessed an increase of 11% in cost of goods sold and a rise of 10.5% in operating expenses during the reported quarter. The company continues to expect an increase in the band of 7-9% in operating expenses during fiscal 2020.

Performance by Categories

We note that Fuel sales increased 11.5% to $1,376 million. Fuel gallons same-store sales declined 2% compared with a 3.4% decline in the year-ago quarter. Fuel margin of 21.7 cents per gallon fell 1.8% year over year.

Management envisions fiscal 2020 fuel gallons same-store sales decline of 1% to up 0.5% compared with decline of 1.7% witnessed in fiscal 2019. It expects fuel margin in the range of 21-23 cents per gallon compared with 20.3 cents reported in fiscal 2019.

Grocery & Other Merchandise sales rose 7.1% to $582.4 million, while same-store sales rose 3.5% compared with 3.4% growth registered in the year-ago quarter. Grocery & Other Merchandise margin expanded 100 basis points (bps) to 32.9%. Casey's reaffirmed same-store sales growth forecast at 2.5-4% with margin expected between 32% and 33% for fiscal 2020. Notably, the company had reported same-store sales increase of 3.6% and margin expansion of 30 bps to 32.1% in fiscal 2019.

Prepared Food & Fountain sales jumped 6.8% to $273.6 million. In spite of a competitive food service environment, same-store sales increased 2.8% compared with 1.5% growth registered in the year-ago quarter. Further, Prepared Food & Fountain margin shrunk 210 bps to 60.2%. Higher commodity costs compared with the year-ago period and increased promotional activity affected margins.

Management projects prepared food and fountain same-store sales increase of 1.5-4% with margin between 61% and 63% for fiscal 2020. Notably, the company had reported same-store sales increase of 1.9% and margin expansion of 120 bps to 62.2% in fiscal 2019.

Store Update

During the nine months ended on Jan 31, 2020, the company constructed 50 new stores and acquired 10. The company closed 12 stores. As of Jan 31, the company operated 2,193 stores. It plans to construct 60 stores and acquire 20 in fiscal 2020.

Other Financial Aspects

Casey's ended the reported quarter with cash and cash equivalents of $43.5 million, long-term debt (net of current maturities) of $715.1 million and shareholders’ equity of $1,588.6 million. During the quarter, the company did not make any share repurchases and still has $300 million under authorization.

3 Picks You Can’t Miss Out On

Macy's (NYSE:M) has a long-term earnings growth rate of 7.5% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco (NASDAQ:COST) has a long-term earnings growth rate of 8.4% and a Zacks Rank #2 (Buy).

Zumiez (NASDAQ:ZUMZ) witnessed a positive earnings surprise in the last reported quarter. It carries a Zacks Rank #2.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Macy's, Inc. (M): Free Stock Analysis Report

Casey's General Stores, Inc. (CASY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.