Shares of

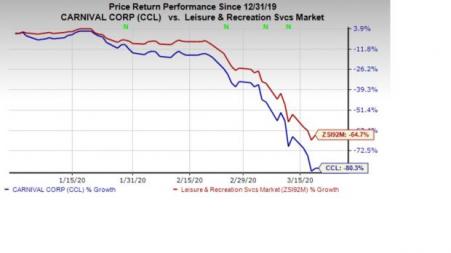

Carnival Corporation (NYSE:) have been affected by the coronavirus outbreak that has become a pandemic. Moreover, voyage disruptions due to bad weather, increased fuel prices, the Trump administration's policy change on travel to Cuba as well as negative currency translation and macroeconomic issues in key operating regions are concerns. Notably, shares of Carnival have plummeted 80.3% so far this year compared with the

industry’s decline of 64.7%.

Factors Affecting the Company

The global stock markets have been rattled by the coronavirus crisis and cruise stocks are not immune to the trend.

Thanks to the novel coronavirus outbreak, Carnival’s Princess Cruises operations have been halted for two months. Princess operates 18 cruise ships, which contributes more than 20% to the company’s earnings before interest, taxes, depreciations and amortization. Cancellations are impacting booking trends, which in turn will impact 2020 financial results. The company is providing guests with opportunity to transfer 100% of the money paid for their cancelled cruise to a future cruise of their choice.

The company’s Seabourn Brand along with four additional North American cruise line brands have also paused global operations for 30 days. Notably, the decisions were in sync with the unpredictable circumstances evolving from the outbreak and the following mandatory precautions. Markedly, travel warnings and cruise cancellations are starting to take a toll on the industry.

Moreover, The Cruise Lines International Association submitted a plan to Vice President Michael Pence suggesting that any person over the age of 70 years shouldn’t be allowed to board a cruise if they fail to provide fitness certificate from a doctor. Per Cruise Lines International Association, the average age of passengers on cruises is 47, while 14% are 70 years or above.

While cruise business from China and Asia fell significantly, bookings for the broader business outside Asia has also softened recently thanks to travel restrictions to contain the outbreak.

However, the company’s initiatives to tap into the fast-growing Asian markets along with strategies to expand its global fleet will not be fruitful unless and until the coronavirus scare eases out. The company also aims to formulate measured capacity growth over time that enables its global fleet to meet escalating demand for cruise vacations in every region of the world.

Zacks Rank & Key Picks

Some better-ranked stocks in the same space are Camping World Holdings, Inc. (NYSE:) , RCI Hospitality Holdings, Inc. (NASDAQ:) and WW International, Inc. (NASDAQ:) , each sporting a Zacks Rank #1.

Camping World Holdings’ and RCI Hospitality’s 2020 earnings are expected to rise 330.3% and 12.6%, respectively.

WW International has a three-five year expected earnings per share growth rate of 17.4%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

Carnival Corporation (CCL): Free Stock Analysis ReportCamping World Holdings Inc. (CWH): Free Stock Analysis ReportRCI Hospitality Holdings, Inc. (RICK): Free Stock Analysis ReportWW International, Inc. (WW): Free Stock Analysis ReportOriginal postZacks Investment Research

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.