- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CannTrust (CTST) To Report Q4 Earnings: What's In Store?

At fourth-quarter 2019 earnings conference, we expect investors to focus on CannTrust Holdings Inc.’s (NYSE:CTST) updates related to its default status reports and the completion of its remediation activities in various facilities.

On Feb 25, 2019, the company started trading on the New York Stock Exchange (NYSE) under the ticker symbol CTST.

Last month, CannTrust received a written notification from the NYSE, which stated that the company is no longer in compliance with the NYSE’s continued listing standard rules as the per share trading price of the company’s common stock fell below the NYSE’s share price rule.

However, CannTrust will have six months’ time to regain compliance from the date of this notice issued. During this period, the company’s shares will continue to be listed and trade on the NYSE as usual.

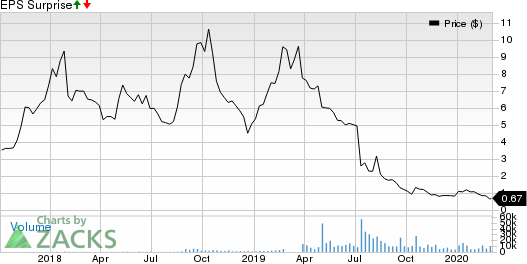

Shares of CannTrust have plunged 92.6% in the past year compared with the industry’s decrease of 15.2%.

Last month, the company appointed Greg Guyatt as its new CEO.

Let’s see, how things are shaping up for this announcement.

Key Factors to Note

CannTrust is a federally-regulated licensed producer of medical and recreational cannabis in Canada. The company’s revenues are generated from the sale of cannabis products, both in the medical and the recreational markets.

However, the company currently has no meaningful revenue base and remains default of its disclosure obligations under securities legislation. The company laid off a significant portion of its workforce and is facing several regulatory investigations. It also has significant contingent liabilities in both Canada and the United States.

We believe, investors will be keen to know the updates on the above events during the upcoming conference call.

Recent Developments

Last month, the company announced that it will file documents to Health Canada regarding the completion of its remediation activities at its Niagara Facility.

Meanwhile, CannTrust expects remediation activities at the Vaughan Facility to be completed by the second quarter of 2020. Notably, in October 2019, CannTrust submitted a detailed remediation plan to Health Canada for the reinstatement of the facility’s licenses.

However, management stated that there can be no assurance that Health Canada will reinstate either the Niagara or Vaughan Facility licenses. We expect a detailed update on the same at the upcoming earnings presser.

Notably, CannTrust has not announced any financial results since reporting its first-quarter 2019 earnings performance.

Zacks Rank

CannTrust currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CannTrust Holdings Inc. Price and EPS Surprise

Stocks That Warrant a Look

Here are a few healthcare stocks worth considering as our model shows that these have the right mix of elements to beat estimates this time around.

ChemoCentryx, Inc. (NASDAQ:CCXI) has an Earnings ESP of +14.18% and a Zacks Rank #3.

AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) has an Earnings ESP of +28.04% and is Zacks #3 Ranked.

Harpoon Therapeutics, Inc. (NASDAQ:HARP) has an Earnings ESP of +13.51% and is a #3 Ranked stock.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

AVEO Pharmaceuticals, Inc. (AVEO): Free Stock Analysis Report

ChemoCentryx, Inc. (CCXI): Free Stock Analysis Report

CannTrust Holdings Inc. (CTST): Free Stock Analysis Report

Harpoon Therapeutics, Inc. (HARP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.