- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Canadian Solar (CSIQ) Q3 Earnings In Line, Revenues Beat

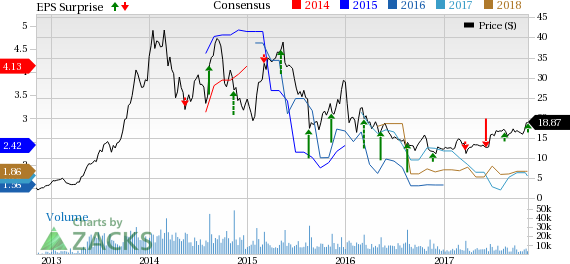

Solar cell manufacturer, Canadian Solar Inc. (NASDAQ:CSIQ) reported third-quarter 2017 adjusted earnings of 22 cents per share, in line with the Zacks Consensus Estimate. The figure was lower than earnings of 27 cents per share recorded a year ago.

Total Revenue

Canadian Solar posted total revenues of $912.2 million in the quarter, which surpassed the Zacks Consensus Estimate of $819 million by 11.4%. The top line was also up 38.8% from $657.3 million reported in the third quarter of 2016.

Operational Update

Solar module shipments in the quarter totaled 1,870 megawatts (MW), up 7.2%, from the year-ago level of 1,745 MW. The figure also exceeded management’s guidance range of 1,650 MW to 1,700 MW.

Gross profit was $159.8 million, up 36.2%, from the year-ago level of $117.3 million. Gross margin was 17.5% in the quarter compared with 17.8% in the prior-year quarter.

Total operating expenses were $102 million, up 13% year over year. Selling expenses totaled $42.8 million, up 26.1%. General and administrative expenses were $53.3 million, slightly up from $52.5 million. Research and development expenses were $7.3 million compared with $4.6 million a year ago.

Interest expenses were $33.7 million, up from $18.8 million recorded in a year ago.

Financial Update

As of Sep 30, 2017, cash and cash equivalents were $614.6 million, up from $511 million as of Dec 31, 2016.

Long-term debt as of Sep 30, 2017, was $318.2 million, down from $493.5 million as of Dec 31, 2016.

Guidance

For fourth-quarter 2017, Canadian Solar expects shipments in the band of 1.65-1.75 gigawatts (GW). Total revenues are projected in the range of $1.77-$1.81 billion along with gross margin in the 10.5-12.5% band.

Canadian Solar’s total module shipments in 2017 are now anticipated to be in the range of 6.7 GW to 6.8 GW, up from 6.0 GW to 6.5 GW, projected earlier. Total revenues are expected to be in the range of $4.05-$4.09 billion

Zacks Rank

Canadian Solar carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

SunPower Corp. (NASDAQ:SPWR) reported third-quarter 2017 earnings of 21 cents per share. The Zacks Consensus Estimate was pegged at a loss of 36 cents. In the year-ago period, the company had reported earnings of 88 cents per share.

First Solar Inc. (NASDAQ:FSLR) reported third-quarter 2017 adjusted earnings of $1.95 per share, beating the Zacks Consensus Estimate of 85 cents by a whopping 129.4%. The reported number also improved 60% from the prior-year figure of $1.22.

8point3 Energy Partners LP (NASDAQ:CAFD) reported earnings of 27 cents per share in third-quarter fiscal 2017 (ended Aug 31), which missed the Zacks Consensus Estimate of 65 cents by 58.5%. The bottom line also declined 40.7% from 38 cents in the year-ago period.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

First Solar, Inc. (FSLR): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

8point3 Energy Partners LP (CAFD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.