- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Canadian Natural (CNQ) Q4 Earnings Lag On Lower Gas Prices

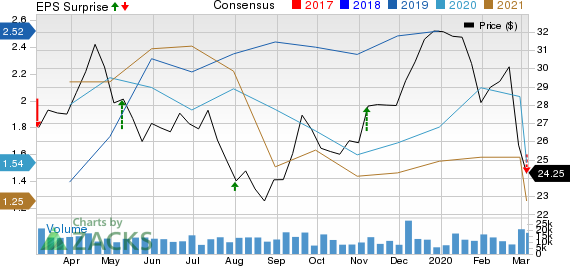

Canadian Natural Resources Limited (TSX:CNQ) reported fourth-quarter 2019 adjusted earnings per share of 44 cents, below the Zacks Consensus Estimate of 54 cents due to lower natural gas price realizations plus higher costs and expenses. However, the bottom line delivered a profit against the prior-year adjusted loss of 16 cents per share, driven by robust production and higher liquids realizations.

Total revenues of $4,471 million missed the Zacks Consensus Estimate of $4,546 million. However, the top line improved from fourth-quarter 2018 revenues of $2,801 million.

Apart from bettering year-over-year revenues and earnings, the company’s fourth-quarter results offered something more to buoy long-term investors’ optimism as free cash flow totaled C$994 million after adjusting capital expenditure and dividend payments.

Production & Prices

Canadian Natural reported quarterly production of 1,156,276 barrels of oil equivalent per day (BOE/d), up by 6.9% from the prior-year quarter. Oil and natural gas liquids (NGLs) output (accounting for more than 79% of total volumes) increased to 913,782 barrels per day (Bbl/d) from 833,358 Bbl/d a year ago. Crude oil and NGLs production from operations in North America including synthetic crude oil production of 357,856 Bbl/d and bitumen output of 259,387 Bbl/d came in at 864,427 Bbl/d, higher than the year-ago quarter’s 790,102 Bbl/d on the back of contribution from the buyout of Devon Energy (NYSE:DVN) Corporation’s (DVN) Canadian business.

Natural gas volumes recorded a 5.4% year-over-year decline from 1,488 million cubic feet per day (MMcf/d) to 1,455 MMcf/d in the quarter under review. Production in North America totaled 1,411 MMcf/d compared with 1,441 MMcf/d in the prior year.

Canadian Natural’s realized natural gas price was C$2.64 per thousand cubic feet compared with the year-ago level of C$3.46. Realized oil and NGLs price escalated 91% to C$49.60 per barrel from C$25.95 in the fourth quarter of 2018.

Costs & Capital Expenditure

Total expenses incurred in the quarter were C$5,079 million, higher than C$4,601 million recorded a year ago. Elevated transportation costs, foreign exchange loss and the absence of revaluation gains flared up the overall costs. In the reported quarter, capital expenditure summed C$1,056 million excluding costs associated with the Devon Energy assets.

Dividend & Share Repurchase

The company, which is committed to adding shareholder value, returned C$444 million and C$140 million via dividends and stock buybacks, respectively.

Canadian Natural declared a 13% hike in its dividend to 42.5 Canadian cents a share, payable Apr 1, 2020 to its shareholders of record as of Mar 20, 2020. This marks the company’s 20th consecutive dividend raise.

Balance Sheet

As of Dec 31, the company had C$139 million in cash and cash equivalents, and a long-term debt of C$18,591 million, representing a debt-to-capitalization ratio of 34.7%.

2020 Guidance

Canadian Natural expects capex to be C$3.95 billion for the full year. While liquids output is expected between 910,000 Bbl/d and 970,000 Bbl/d, natural gas production is predicted within 1,360-1,420 MMcf/d.

Zacks Rank & Key Picks

Canadian Natural has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Contango Oil & Gas Company (NYSE:MCF) , Apache Corporation (NYSE:APA) and Chesapeake Energy Corporation (NYSE:CHK) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Chesapeake Energy Corporation (CHK): Free Stock Analysis Report

Apache Corporation (APA): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Contango Oil & Gas Company (MCF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.