- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can Value Investors Consider Cisco Systems (CSCO) Stock?

Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put Cisco Systems, Inc. (NASDAQ:CSCO) stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

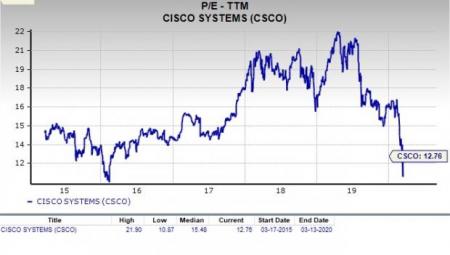

PE Ratio

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short. This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world. The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

On this front, Cisco Systems has a trailing twelve months PE ratio of 12.76, as you can see in the chart below:

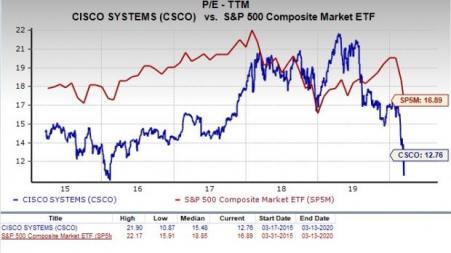

This level also compares favorably with the market at large, as the PE for the S&P 500 stands at about 16.89. Meanwhile, if we focus on the long-term PE trend, Cisco Systems’ current PE level puts it below its midpoint of 15.48 over the past five years.

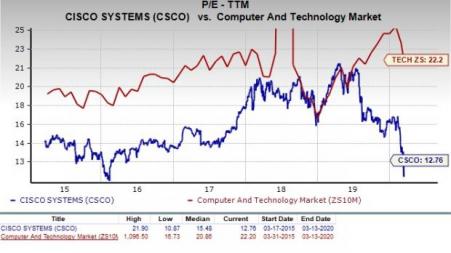

The stock’s PE also compares quite favorably with the Computer and Technology Market’s trailing twelve months PE ratio, which stands at 22.2. This indicates that the stock is undervalued right now, compared to its peers.

We should also point out Cisco Systems has a forward PE ratio (price relative to this year’s earnings) of 11.57, so it is fair to say that a more value-oriented path is ahead of the stock in the near term.

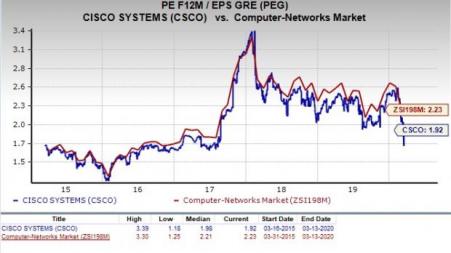

PEG Ratio

While earnings are certainly important, it is essential to know how much you are paying for the growth of earnings as well. One can easily do that with the PEG ratio (ratio of the P/E to the expected future earnings growth rate). The PEG ratio gives a more complete picture of the valuation of a stock than the P/E ratio.

Cisco Systems’ PEG ratio stands at just 1.92, compared with the Zacks Computer Market’s average of 2.23. This suggests a decent undervalued trading relative to its earnings growth potential right now.

Broad Value Outlook

In aggregate, Cisco Systems currently has a Value Score of B, putting it into the top 40% of all stocks we cover from this look. This makes Cisco Systems a solid choice for value investors.

What About the Stock Overall?

Though Cisco Systems might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. In particular, it is worth noting that the company has a Growth Score of C and a Momentum Score of D. This gives CSCO a Zacks VGM score — or its overarching fundamental grade — of B. (You can read more about the Zacks Style Scores here >>).

Meanwhile, the company’s recent earnings estimates have been somewhat downbeat. While the current-quarter estimate has seen one upward and three downward movements, the current-year estimate has seen five upward and five downward movements over the past two months.

This has had a negative effect on the consensus estimate. While the current-quarter consensus has dropped 1.2% over the past two months, the current-year estimate has remained stable. You can see the consensus estimate trend and recent price action for the stock in the chart below:

Despite this somewhat bearish trend, the stock has a Zacks Rank #3 (Hold) and it is the reason why we are looking for inline performance from the company in the near term.

Bottom Line

Cisco Systems is an inspired choice for value investors, as it is hard to beat its incredible lineup of statistics on this front. Besides a sluggish industry rank (among bottom 34% of more than 250 industries), with a Zacks Rank #3 it is hard to get too excited about the stock.

Also, over the past two years, the broader industry has clearly underperformed the market at large, as you can see below:

Hence, value investors might want to wait for Zacks Rank, past industry performance, industry rank and analyst sentiments to turn around in the name first, but once that happens, the stock is going to be a compelling pick.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.