- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can Valeant (VRX) Turn Around On Rebuilding Initiatives?

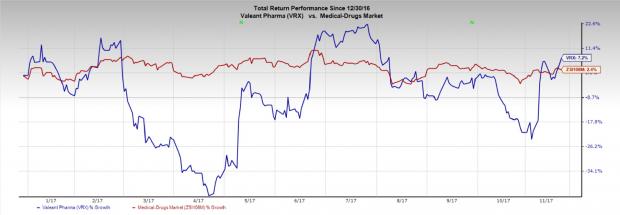

Shares of Valeant Pharmaceuticals International Inc. (NYSE:VRX) have rallied 7.2% year to date compared with the industry’s gain of 2.4%.

We note that the stock has lost 85.2% last year. After a tumultuous period, Valeant started a rebuilding process with CEO, Joseph C. Papa. Even though it is still early to comment on the rebuilding process, but the company’s efforts to sell non-core assets and clear debt is commendable and should bode well in the upcoming quarters.

Valeant sold its equity interests in Dendreon Pharmaceuticals, Inc. to the China-based Sanpower Group Co. Ltd. Valeant has also announced plans to divest Obagi. The company also sold iNova Pharmaceuticals for $930 million.

The company is also divesting Sprout Pharmaceuticals and ADDYI businesses. As of Nov 7, 2017, the company lowered debt by approximately $6 billion since the end of first-quarter 2016. The divestiture of non-core assets should help the company streamline its product portfolio and focus better on core areas of dermatology and clear debt as well.

Meanwhile, the approval of new drugs is also likely to boost the company’s portfolio. The FDA has approved the Biologics License Application for Siliq (brodalumab) injection, for subcutaneous use for patients with moderate-to-severe plaque psoriasis. The company had an agreement with AstraZeneca plc (NYSE:AZN) for Siliq but the deal has been amended. Valeant’s NDA for Plenvu has been accepted by the FDA. A low volume (1L) polyethylene glycol-based bowel preparation, Plenvu, has been developed for bowel cleansing, with added focus on the ascending colon. This, in turn, is expected to enhance bowel cleansing and the overall experience relating to colonoscopy. The drug, upon approval, will offer the lowest solution for an FDA-approved bowel cleanser in the market. The drug will have an edge over high preparation volumes which sometimes can be a deterrent in patients completing their regimen.

The company also received clearance for the Thermage FLX System to non-invasively smooth skin on the face, eyes and body. The FDA also approved Vyzulta for open-angle glaucoma.

On the other hand, uptake of Xifaxan and the launch of Relistor tablets drove prescription growth by 61% in the third quarter. Meanwhile, pricing in the dermatology business is beginning to stabilize. The Bausch + Lomb International segment and Salix businesses are doing well.

Consequently, we believe things are definitely looking up for Valeant.

Zacks Rank & Key Picks

Valeant currently carries a Zacks Rank #3 (Hold).

Some better-ranked health care stocks in the same space are Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) and Corcept Therapeutics Incorporated (NASDAQ:CORT) carrying a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ligand’s earnings per share estimates have moved up from $3.68 to $3.70 for 2018 over the last 60 days. The company delivered positive earnings surprises in two of the trailing four quarters, with an average beat of 8.22%. The share price of the company has increased 28.4% year to date.

Corcept’s earnings per share estimates have moved up from 45 cents to 47 cents for 2017 and from 77 cents to 88 cents for 2018 over the last 60 days. The company delivered positive earnings surprises in two of the trailing four quarters, with an average beat of 14.32%. The share price of the company has increased 135.4% year to date.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Valeant Pharmaceuticals International, Inc. (VRX): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.