- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can Sysco's Key Strategies For 2020 Spur Further Growth?

Sysco Corporation (NYSE:SYY) recently outlined its key growth strategies at New York Investor Day event, wherein it also highlighted its three-year financial goals. Notably, the company has been gaining from cost-saving and revenue-management efforts for quite some time now, as evident from its impressive past record.

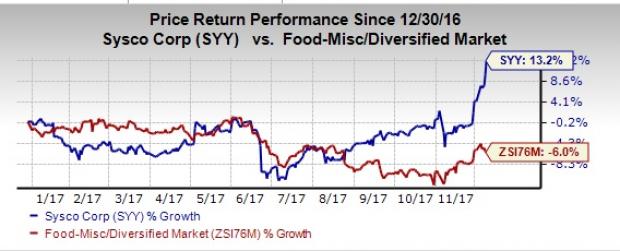

These efforts, along with constant focus on buyouts have helped Sysco gain 13.2% this year, as against the industry’s decline of 6%. So let’s delve deeper into Sysco’s plans to achieve its financial targets for fiscal 2020, and see if it can spur further growth of this Zacks Rank #3 (Hold) company.

Sysco’s Core Strategies

Sysco stated that its four core strategies include enhancing consumers’ experience; optimising business; stimulating power of its people and achieving operational efficacy. In this regard, the company remains focused on enhancing assortments, making constant innovations, ensuring food safety and revitalising brands.

Further, to evolve with the changing consumer preferences, Sysco remains committed toward investing in technology and enhancing e-commerce operations.Moreover, the company plans to improve supply chain, increase transparency through technological advancements, enhance deliveries and attain operational efficiency. Clearly, the company intends to keep customers interests at the centre of business.

Well, Sysco’s focus on undertaking innovative technologies to fuel efficiency is clear from its recently announced investment in Tesla (NASDAQ:TSLA) . Incidentally, the company revealed that it reserved 50 new fully-electric Semi tractors at Tesla to introduce alternative-fuel vehicles to its fleet. This move will not only be environment friendly, but is also likely to curtail Sysco’s fuel and transportation expenses considerably.

Financial Targets

Moving back to the company’s four core strategies, management believes that these will help it achieve its financial goals for fiscal 2020. The company expects gross profit to rise in a band of 55-65%, while it anticipates reducing administrative expenses by 20-25%. Consequently, the company plans to achieve adjusted operating income growth of about $650-$700 million by fiscal 2020 end, reflecting a three-year CAGR of 9%.

Moreover, management envisions earnings per share to grow at a double-digit rate on an average, by 2020. Additionally, the company’s solid balance sheet and free cash flow augmenting ability will help it make business investments, continue with merger and acquisitions, make share buybacks, repay debt and attain a preferred dividend payout ratio of 50-60% over time. Also, Sysco expects ROIC to be roughly 16% in fiscal 2020.

All said, we believe that these strategic priorities are likely to aid the company enhance customers’ experience, drive growth and in turn augment shareholder value.

Looking for More? Check These Consume Staples Stocks

Conagra Brands, Inc. (NYSE:CAG) , with a long-term EPS growth rate of 7% carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Flowers Foods, Inc. (NYSE:FLO) with a long-term EPS growth rate of 6.1% holds the same Zacks Rank as Conagra.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Tesla Inc. (TSLA): Free Stock Analysis Report

Sysco Corporation (SYY): Free Stock Analysis Report

Conagra Brands Inc. (CAG): Free Stock Analysis Report

Flowers Foods, Inc. (FLO): Free Stock Analysis Report

Original post

Related Articles

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.