- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can Home Builders Continue To Thrive Amid Coronavirus Threat?

Wall Street has been grappling with the coronavirus-induced volatility since the last week of February. While almost all industries have been bearing the brunt of this turmoil, one industry — the home builders — has kept on growing. A stable U.S. economy and record low market interest rate, which resulted in sharp decline in mortgage rate, primary catalysts driving the industry.

Housing Market on Strong Footing

While the broader market has been volatile amid mounting global panic over the economic impact of the coronavirus outbreak, housing is expected to remain shielded. Presently, the economic backdrop for U.S. housing is favorable as declining interest/mortgage rates, low unemployment and increasing wages are somewhat offsetting the headwinds. Moreover, the increasing shift of millennials from their parental homes is driving demand for new homes. (Read More: What Fed's Hasty Rate Cut Means for Housing Amid Corona Scare)

Per the latest report by the Department of Commerce, spending on private construction increased 1.5% to $1.023 trillion in December. Spending on home construction climbed 2.1%, reflecting the biggest gain since August. The gain was driven by a 2.7% rise in single-family home constructions. Nonresidential construction was up 0.8% buoyed by strong shopping centers and religious center constructions.

Record-Low Mortgage Rates

The U.S. housing market saw an uptick in the second half of 2019, courtesy of the Federal Reserve’s three consecutive interest rates cuts from July to September. With interest rates low, mortgage rates remain low, helping consumers to borrow more easily.

Meanwhile, on Mar 3, the Fed reduced the benchmark lending rate by 50 basis points in order to support the longest economic expansion, which was under the threat of coronavirus-led global economic slowdown. However, investors continue to aggressively shift their funds from equities to safe-haven U.S. government bonds.

Consequently, bond prices skyrocketed and yields plunged. On Mar 5, the yield on the 10-Year US Treasury Note plummeted to 0.924% after declining to its all-time low of 0.902%. The benchmark sovereign bond recorded its 11th straight losing-streak.

Notably, the yield on 10-Year US Treasury Note is closely linked with the mortgage rate. Mortgage News Daily’s survey showed that 30-year fixed-rate mortgages declined to 3.13%, on average from the November 2018 peak of 4.94% — the lowest rate in eight years.

Moreover, a few market experts are of the opinion that the latest rate cut may help the U.S. economy somewhat by boosting the housing market. Moody’s Analytics Chief Economist Mark Zandi said that the rate cut is expected to aid the domestic economy, in part by boosting the housing market and helping businesses that require to finance their operations in the short term. Notably, the housing market constitutes 3.1% of the U.S. GDP.

Major Gainers

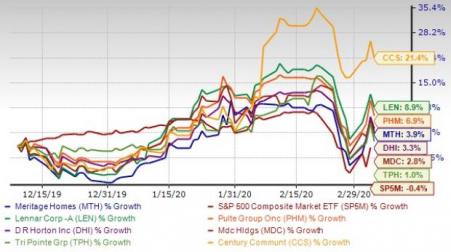

Although, the extent of the virus impact is subject to capability of U.S. home builders to substitute products from China with supplies from domestic or international vendors, several builders have adequate resources to adjust their supply-chain systems. Consequently, share prices of several home builders are still in the positive territory while the broad-market S&P 500 index is in the red with a loss of 6.4%.

Some of the attractive stocks are PulteGroup Inc. (NYSE:PHM) , Meritage Homes Corp. (NYSE:MTH) , Lennar Corp. (NYSE:LEN) , TRI Pointe Group Inc. (NYSE:TPH) , M.D.C. Holdings Inc. (NYSE:MDC) , Century Communities Inc. (NYSE:CCS) and D.R. Horton, Inc. (NYSE:DHI) .

The chart below shows the price performance of above-mentioned seven stocks in the past three months.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PulteGroup, Inc. (PHM): Free Stock Analysis Report

TRI Pointe Group, Inc. (TPH): Free Stock Analysis Report

Lennar Corporation (LEN): Free Stock Analysis Report

Century Communities, Inc. (CCS): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

Meritage Homes Corporation (MTH): Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.