- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Campbell Soup's (CPB) Q2 Earnings, Revenues Top Estimates

Campbell Soup Company (NYSE:CPB) released second-quarter fiscal 2020 results, with earnings and revenues beating the Zacks Consensus Estimate. Moreover, the bottom line increased year over year. Also, management raised earnings view for fiscal 2020. Further, the company highlighted that proceeds from the completion of its previously-announced divestiture has helped it to curtail debt load.

Q2 Highlights

Adjusted earnings from continuing operations increased 11% year over year to 72 cents and surpassed the Zacks Consensus Estimate of 65 cents. The upside was backed by higher adjusted EBIT and reduced interest expenses.

Net sales came in $2,162 million in the quarter. The company had reported a net sales figure of $2,172 million in the year-ago quarter. Further, the top line surpassed the Zacks Consensus Estimate of $2,155 million.

Moving on, adjusted gross margin improved 150 basis points to 34.4% on the back of cost-saving efforts, productivity enhancements and gains from favorable product mix. This was partly negated by cost inflation. Adjusted EBIT rose 4% to $364 million, driven by higher gross margin.

Segment Analysis

Meals & Beverages: Sales in this division were flat year over year at $1,224 million. Notably, Prego pasta sauces and U.S. soup performed well during the quarter that was partly offset by declines in beverages. Also, U.S. soup sales inched up 1% courtesy of gains across broth and condensed soups. This was partly offset by declines in ready-to-serve soups. The segment’s organic sales were flat year over year.

Further, operating earnings in the Meals & Beverages segment declined 4% to $242 million due to increased marketing and administrative costs.

Snacks: Sales in this division declined 1% to $938 million. Nevertheless, organic sales improved 2%. The segment gained from advancements in Pepperidge Farm cookies, Kettle Brand, Goldfish crackers and Cape Cod. The upside was partially offset by declines in fresh bakery products as well as the partner brands in Snyder’s-Lance portfolio. Operating earnings in this category increased 3% to $136 million as improved gross margin were offset by elevated marketing expenses.

Financials

Campbell ended the quarter with long-term debt of $4,919 million and total equity of $2,499 million. Additionally, the company generated $663 million as net cash from operating activities in six months ended Jan 26, 2020. Campbell paid out dividends worth $213 million during the first half of fiscal 2020 at the rate of 35 cents per share.

Other Developments & Fiscal 2020 Outlook

During the quarter under review, Campbell generated savings worth $45 million as part of its multi-year, cost-saving program, which included synergies associated with the Snyder’s-Lance buyout. With this, the company has generated total program-to-date savings of $650 million. Further, management continues to anticipate cumulative annualized savings from continuing operations of $850 million by fiscal 2022-end.

Campbell revised its adjusted earnings per share (EPS) guidance for fiscal 2020 on the back of lower adjusted net interest expenses stemming from reduced debt along along with an impressive EBIT momentum through the first half of the fiscal. Campbell now expects adjusted EPS in the range of $2.55-$2.60, which indicates growth of 11-13%. Earlier, management envisioned EPS to grow 9-11% to $2.50-$2.55.

Further, Campbell reaffirmed its guidance for net sales and organic net sales as well as adjusted EBIT. For fiscal 2020, net sales are projected between a decline of 1% and an increase of 1%. Organic net sales are also expected in the same range as net sales. Adjusted EBIT is still expected to rise 2-4%.

The guidance for fiscal 2020 takes into consideration gains from an additional 53rd week.

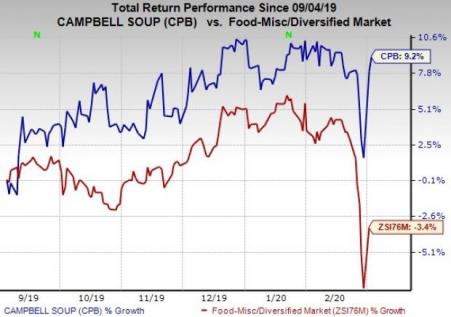

Price Performance & Zacks Rank

We note that this Zacks Rank #3 (Hold) stock has gained 9.2% in the past six months against the industry’s decline of 3.4%.

Don’t Miss These Solid Consumer Staple Bets

Lamb Weston (NYSE:LW) , with a Zacks Rank #2 (Buy), has long-term EPS growth rate of 8.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hershey Co. (NYSE:HSY) , which carries a Zacks Rank #2, has a long-term earnings growth rate of 7.7%.

e.l.f. Beauty Inc. (NYSE:ELF) , which carries a Zacks Rank #2, has a long-term earnings growth rate of 3.8%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Hershey Company (The) (HSY): Free Stock Analysis Report

Campbell Soup Company (CPB): Free Stock Analysis Report

e.l.f. Beauty Inc. (ELF): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.