- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Campbell (CPB) Misses On Q1 Earnings & Sales, Stock Down 8%

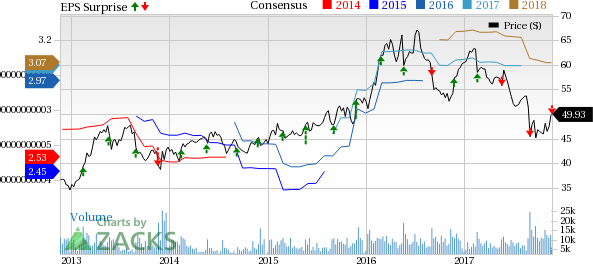

Campbell Soup Company (NYSE:CPB) posted first-quarter fiscal 2018 results, wherein both earnings and sales missed the Zacks Consensus Estimate and declined year over year. This marks the third consecutive quarter of negative earnings surprise with fourth straight revenue miss.

Per management, the underperformance was due to a volatile operating environment along with intense competition and fast evolving retail landscape. These have been pressuring the company’s top line for a while now.

Consequently, shares of the company are down 8.8% in the pre-market trading, owing to dismal first-quarter results and unimpressive outlook for fiscal 2018. Overall, Campbell’s shares have lost 7.5% in the last three months, wider than the industry’s decline of 2.2%.

Q1 Highlights

Adjusted earnings of 92 cents per share dropped 8% year over year and lagged the Zacks Consensus Estimate of 97 cents. Including one-time items, Campbell reported earnings of 91 cents per share that decreased 3% from the year-ago quarter.

Net sales of $2,161 million slipped 1.9% and also missed the Zacks Consensus Estimate of $2,179.6 million, mainly owing to soft organic sales. Organic sales dipped 2% on account of lower volumes, mainly in the Americas Simple Meals and Beverages segment.

Further, the company’s adjusted gross margin contracted 2.1 percentage points to 36.5%. The decline was mainly due to cost inflation, escalated supply chain expenses and adverse mix, somewhat negated by productivity improvements as well as gains from cost savings.

Moreover, adjusted EBIT for the quarter fell 14% to $417 million owing to lower gross margin, soft sales and increased adjusted administrative costs, partly compensated with lower marketing and selling costs.

Segment Analysis

The Latin America business is supervised as part of the Global Biscuits and Snacks segment starting from fiscal 2018. Earlier, this formed part of the Americas Simple Meals and Beverages segment.

Campbell reports its results under three segments, namely, Americas Simple Meals and Beverages, Global Biscuits and Snacks, and Campbell Fresh.

Americas Simple Meals and Beverages: In first-quarter fiscal 2018, sales at the division dipped 5% year over year to $1,218 million, on account of softness in V8 beverages and soup sales. Sales for the U.S. soup dropped 9% owing to a drop in condensed soups, broth as well as ready-to-serve soups. This was somewhat offset by benefits from Prego pasta sauces.

Global Biscuits and Snacks: Sales at this division rose 3% at $709 million. Excluding the impact of currency tailwinds, sales grew 2% backed by Pepperidge Farm snacks strength, representing growth in Goldfish crackers and Pepperidge Farm cookies.

Campbell Fresh: Sales at this segment remained flat at $234 million on the back of greater Garden Fresh Gourmet sales, Bolthouse Farms salad dressings along with strength across carrot ingredients. This was partially offset by soft carrot sales. Also, sales of Bolthouse Farms refrigerated beverages remained flat.

Financials

Campbell ended the quarter with cash and cash equivalents of $163 million, long-term debt of $2,269 million and total equity of $1,689 million. Further, the company generated $188 million as cash flow from operations during the first quarter.

Fiscal 2018 Outlook

Campbell remains focused on getting its C-Fresh division back on growth track, by solving the problems related to soft carrot sales and beverage products. Its solid focus on cost savings and core strategic imperatives are likely to drive growth in the long term.

Management updated its outlook for fiscal 2018. Given a tough operating environment, the company still expects sales growth to range from negative 2% to flat. However, adjusted EBIT is expected to decline in the range of 2-4% versus earlier guidance of decrease of 1% to increase of 1%.

Also, the company slashed its adjusted earnings in the band of $2.95-$3.02 per share, representing decline in the range of 1-3%. Earlier, adjusted earnings per share growth were envisioned in the range of $3.04-$3.11, representing flat to increase of 2%. The Zacks Consensus Estimate is currently pegged at $3.07.

Currency headwinds are expected to have a nominal impact on the company’s fiscal 2018 performance.

Campbell currently carries a Zacks Rank #4 (Sell).

Looking For Solid Picks, Check These

Some better-ranked stocks in the same space include McCormick & Company, Incorporated (NYSE:MKC) , B&G Foods, Inc. (NYSE:BGS) and Lamb Weston Holdings, Inc. (NYSE:LW) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

McCormick, with a long-term earnings growth rate of 9.4% has pulled off an average positive earnings surprise of 4% in the last four quarters.

B&G Foods has delivered positive earnings surprise of 14.6% in the last quarter.

Lamb Weston, with a long-term earnings growth rate of 5.7% has come up with positive earnings surprise of 11% in the trailing four quarters.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Campbell Soup Company (CPB): Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.