- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Calgon Carbon (CCC) Q4 Earnings And Sales Beat Estimates

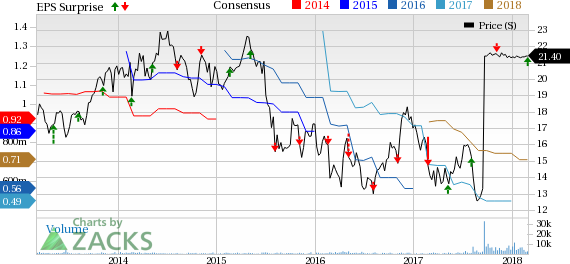

Calgon Carbon Corporation (NYSE:CCC) swung to profit in fourth-quarter 2017. The company reported net income of $9.4 million or 19 cents per share against a net loss of $5.9 million or 12 cents recorded a year ago.

Barring one-time items, adjusted earnings were 16 cents per share that surpassed the Zacks Consensus Estimate of 14 cents.

Calgon Carbon recorded net sales of $161.5 million in the reported quarter, up around 17.5% year over year. The figure beat the Zacks Consensus Estimate of $158 million.

Full-Year 2017 Highlights

For 2017, Calgon Carbon recorded net income of $21.1 million or 42 cents per share compared with $13.8 million or 27 cents recorded a year ago.

Net sales jumped roughly 20.5% to $619.8 million.

Segment Performance

Revenues from the company’s Activated Carbon segment increased 14.5% year over year to $143.9 million in the fourth quarter. The results were mainly driven by increase in New Business as well as gains in legacy business resulting from increased food and beverage, environmental air and specialty end market demand in Asia and higher potable water end market demand in North America and Europe.

The Alternative Material segment’s revenues surged around 80.3% to $13.7 million as the perlite filtration and diatomaceous earth media products of New Business contributed significantly during the quarter.

Sales from the Advanced Water Purification segment declined slightly to $4.1 million from $3.9 million a year ago.

Financial Position

Calgon Carbon ended 2017 with cash and cash equivalents of roughly $42.3 million, up around 11.6% year over year.

Long-term debt was up roughly 3.9% to $228.5 million.

Outlook

Calgon Carbon stated that despite facing a slow and challenging market, the company was able to reach a number of achievements that will benefit it moving ahead. These include completion of the integration of the New Business and exceeding sales target of $100 million for 2017 and winning a $13.2 million water treatment contract for the removal of the 1,2,3-TCP contaminant in California. The company is also executing a number of actions to improve profitability such as business realignment strategies and disposing previously idled assets in the United Kingdom.

Notably, Calgon Carbon has also reached an agreement to merge with Kuraray of Japan and expects to complete the deal in the first quarter of 2018.

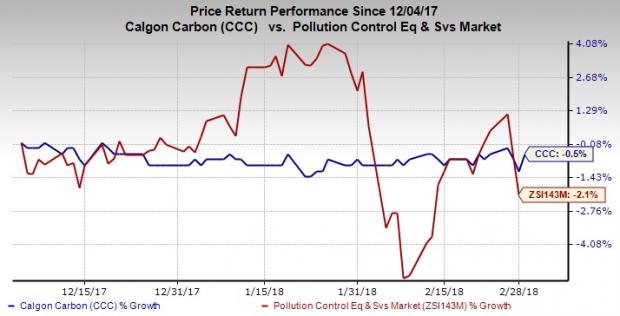

Price Performance

Shares of Calgon Carbon have lost 0.5% over the last three months, outperforming the 2.1% decline of its industry.

Zacks Rank & Stocks to Consider

Calgon Carbon currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industrial products space are Axon Enterprise, Inc. (NASDAQ:AAXN) , Encore Wire Corporation (NASDAQ:WIRE) and Deere & Company (NYSE:DE) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axon has an expected long-term earnings growth rate of 25%. Its shares have moved up 73.5% over the past six months.

Encore Wire has an expected long-term earnings growth rate of 10%. Its shares have rallied 20% over the last six months.

Deere has an expected long-term earnings growth rate of 8.2%. Its shares have soared 35.1% over the last six months.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Encore Wire Corporation (WIRE): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Calgon Carbon Corporation (CCC): Free Stock Analysis Report

TASER International, Inc. (AAXN): Free Stock Analysis Report

Original post

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.