- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

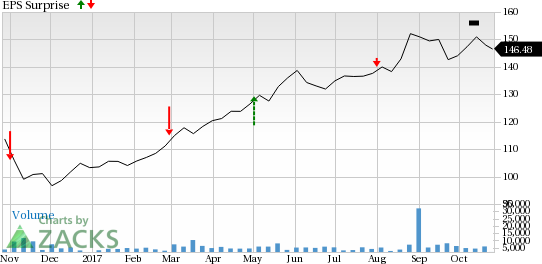

Can SBA Communications (SBAC) Deliver A Beat In Q3 Earnings?

SBA Communications Corporation (NASDAQ:SBAC) is slated to report third-quarter 2017 results on Oct 30, after the closing bell.

Last quarter, the leading independent owner and operator of wireless communications infrastructure in the United States, delivered a negative earnings surprise of 5.00%. Moreover, the company’s earnings lagged the Zacks Consensus Estimate in three of the previous four quarters, with an average miss of 61.93%.

Let’s see how things are shaping up for this announcement.

Why Do We Expect a Positive Surprise?

Our proven model shows that SBA Communications is likely to beat estimates because it has the right combination of the two key elements.

Zacks ESP: SBA Communications has an Earnings ESP of +12.00%. This is because the Most Accurate estimate is at 28 cents, while the Zacks Consensus Estimate is pegged at 25 cents. This is a significant indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with ourEarnings ESP Filter.

Zacks Rank: SBA Communications has a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating estimates.

Meanwhile, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

The combination of the company’s favorable Zacks Rank and positive ESP makes us confident of an earnings beat.

What is Driving the Better-than-Expected Earnings?

SBA Communications is poised to gain from rapid technological improvement in the telecommunication industry. The upcoming 5G wireless network standard is a major positive for wireless tower operators like SBA Communications. Based on its tower operations, the company is optimistic about the global growth of wireless business and thus anticipates international expansion. The company’s tower buyouts in emerging markets and long-term tower leases with major wireless carriers should drive top line and lend it a competitive edge.

On the back of such tailwinds, the company’s shares have rallied 7.7% as against the industry’s decline of 1.5%.

On the flip side, we remain concerned about SBA Communications’ top line which is likely to get affected by high customer concentration and consolidated wireless industry. The company derives majority of its total quarterly revenues from four major domestic wireless carriers — Verizon Wireless, AT&T (NYSE:T), Sprint Corp (NYSE:S) and T-Mobile US Inc (NYSE:S) . Loss of any of these customers or consolidation among them will lead to a significant material impact on the top line.

Although the company’s operations in the United States and other territories boost its geographic expansion and revenues, it may jeopardize the bottom line. Notably, tower operations in emerging markets are not as profitable in the mature domestic market.

Evolution of new technologies may reduce demand for site leases. In addition, frequent changes in demand for network services and infrastructure support will tend to increase volatility in SBA Communications’ revenues.

A Closer View of Certain Important Metrics

Improvement in revenues holds promise for SBA Communications’ segments. While the revenues for the Site Leasing segment is estimated around $408 million by the Zacks Consensus Estimate, while the same for Site Development segment is anticipated at $23.79 million.

In the third quarter of 2017, Domestic Site Leasing revenues are expected at $330 million and International Site Leasing revenues are projected at $77 million.

Per estimates, the company has plans to construct 114 towers and purchase 211 towers in the to-be-reported quarter. The company will acquire 52 domestic sites and 106 international sites in the said quarter. The increase in the number of towers and sites to be purchased portrays an improvement in the company’s operations.

Key Pick

Here is a company in the broader Computer and Technology sector — which houses SBA Communications — which has the right combination of elements to post an earnings beat this quarter.

Windstream Holdings Inc (NASDAQ:WIN) has an Earnings ESP of +18.03% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is expected to release third-quarter 2017 earnings on Nov 6. The company’s earnings beat the Zacks Consensus Estimate in one of the previous four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

SBA Communications Corporation (SBAC): Free Stock Analysis Report

Sprint Corporation (S): Free Stock Analysis Report

Windstream Holdings, Inc. (WIN): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.