- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Arconic's (ARNC) Q3 Earnings Trail, Sales Beat Estimates

Arconic Inc. (NYSE:ARNC) logged profit, as reported, of $119 million or 22 cents per share for the third quarter of 2017, down from $166 million or 33 cents per share a year ago. The results in the reported quarter include special items including restructuring charges.

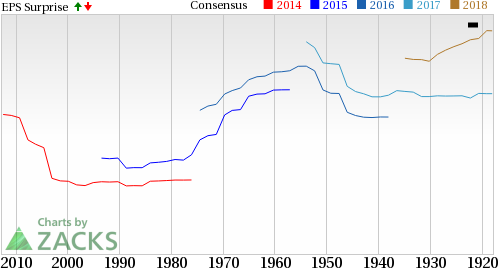

Barring one-time items, earnings came in at 25 cents per share for the reported quarter. The results missed the Zacks Consensus Estimate of 27 cents.

Arconic reported revenues of $3,236 million, up around 3% year over year. Sales topped the Zacks Consensus Estimate of $3,129 million. Revenues were driven by improved volumes across all segments and higher aluminum prices.

Arconic remains focused on cost reduction and delivered net cost savings of 1.5% of revenues in the reported quarter.

Segment Highlights

Engineered Products and Solutions (EPS) – Revenues from the division came in at $1.5 billion in the third quarter, up 5% year over year. Adjusted EBITDA rose 5% year over year to $312 million in the quarter, as improved aerospace volume and cost savings more than offset unfavorable price and mix.

Global Rolled Products (GRP) – The division recorded sales of $1.2 billion in the quarter, down 4% year over year. Adjusted EBITDA fell 2% year over year to $140 million, as lower aerospace wide-body build rates, airframe destocking and pricing pressure more than offset cost savings.

Transportation and Construction Solutions (TCS) – The segment logged sales of $517 million, up 15% year over year. Adjusted EBITDA increased around 9% to $83 million in the quarter on the back of increased volumes and cost savings that more than offset headwinds including unfavorable price and mix.

Financial Position

Arconic ended the quarter with cash and cash equivalents of roughly $1.8 billion. Long-term debt was around $6.8 billion at the end of the third quarter.

Outlook

Arconic reaffirmed its full-year adjusted earnings guidance of $1.15–$1.20 per share. However, the company updated its revenue and capital expenditure outlook for 2017.

The company now sees revenues for 2017 in the range of $12.6 billion to $12.8 billion (up from $12.3 billion to $12.7 billion expected earlier). Arconic now expects capital expenditure to be roughly $600 million, compared with its prior view of up to $650 million.

Price Performance

Arconic has outperformed the industry it belongs to year to date. The company’s shares have gained around 46.5% over this period, compared with roughly 35% gain recorded by the industry.

Zacks Rank & Key Picks

Arconic currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Ingevity Corporation (NYSE:NGVT) , Huntsman Corporation (NYSE:HUN) and FMC Corporation (NYSE:FMC) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has expected long-term earnings growth of 12%.

Huntsman has expected long-term earnings growth of 7%.

FMC has expected earnings growth of 11.3% for the current year.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

FMC Corporation (FMC): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

Arconic Inc. (ARNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.