- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cable Revenues Help 21st Century Fox (FOXA) Top Q1 Estimates

Twenty-First Century Fox, Inc. (NASDAQ:FOXA) just released its first-quarter fiscal 2018 financial results, posting earnings of $0.49 per share and revenues of $7 billion. Currently, FOXA is a Zacks Rank #3 (Hold) and is up marginally to $28.10 per share in after-hours trading shortly after its earnings report was released.

Twenty-First Century Fox:

Beat earnings estimates. The company posted earnings of $0.49 per share, just beating the Zacks Consensus Estimate of $0.48 per share.

Beat revenue estimates. The company saw revenue figures of $7 billion, topping our consensus estimate of $6.87 billion.

Twenty-First Century Fox’s adjusted earnings per share fell from $0.51 in the year-ago period. However, the company’s quarterly revenues popped 8% year-over-year.

The company’s Cable Network Programming revenues jumped from $3.81 billion to $4.19 billion in its first quarter of fiscal 2018. FOXA revenues grew across all of its other operating segments as well, including its Filmed Entertainment unit.

“The Company’s double-digit gains in affiliate revenues demonstrate our strength in the dynamic global

market for distinctive video brands and content, across both established distributors and new entrants,” Executive Chairmen Rupert and Lachlan Murdoch said in a statement.

“We delivered top-line growth at all of our businesses, backed by stand-out storytelling, sports and news, as well as a product focus that will drive greater consumption and compelling opportunities for financial returns on our content investment. Our solid first quarter performance puts us on track to achieve our overall financial and operational objectives for this fiscal year.”

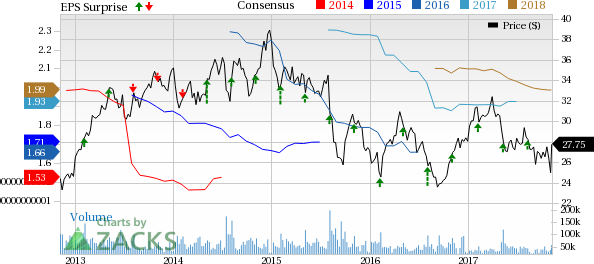

Here’s a graph that looks at FOXA’s Price, Consensus and EPS Surprise history:

Twenty-First Century Fox, Inc. is involved in creating and distributing media services. Its business portfolio consists of cable, broadcast, film, pay TV and satellite assets. Twenty-First Century Fox, Inc., formerly known as News Corporation, is based in New York, United States.

Check back later for our full analysis on FOXA’s earnings report!

Also, make sure you check out the most recent episode of the Full-Court Finance podcast, which dives into how the NFL’s rating might impact broadcast partners such as Fox.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius. Click for details >>

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.