- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Buy These 4 Oil Stocks As The Sector Remains Undervalued

Energy was a key sector driving profits for S&P 500 index in 2017. Per the latest Earnings Trends, the index witnessed year-over-year earnings growth of 7.1% last year. However, excluding the Energy sector, the index’s earnings growth fell drastically to 4.4%.

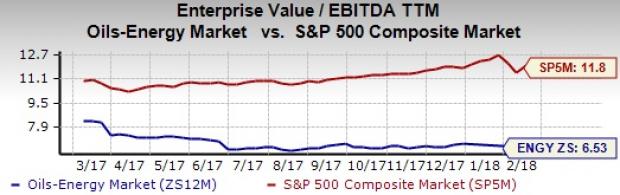

Despite the impressive performance by energy companies, valuation of the sector is not on par with the index. We have employed trailing 12-month Enterprise Multiple for determining the value of the sector. This is because oil energy players typically shoulder significant debt for investing on growth projects and EV includes debt for valuing company or industry.

Enterprise Multiple = Enterprise Value (EV) / EBITDA

Our proprietary model calculates EV/ EBITDA for the Energy sector at 6.53, lower than the index’s 11.8.

Impressive Q4 Results

Among all the 16 sectors defining the index, only energy recorded triple-digit Q4 earnings growth of 157.2%. During fourth-quarter 2017, the Energy sector generated profits of $11.4 billion, compared with the respective $11 billion, $8.1 billion and $9.1 billion during the last three quarters.

Also, the trailing 12-month results show 271.6% earnings growth for Energy on 17.5% higher revenues. Per our data base, the sector raked in $39.3 billion profits in 2017, significantly higher than $9.2 billion through 2016.

Higher oil prices primarily drove the sector’s performance. From the historical low-mark of $26.21 per barrel touched in February 2016, the West Texas Intermediate (WTI) crude rose beyond the $60 psychological level. The extension of the production cut deal, first signed in late 2016, by the OPEC players through the end of 2018, primarily supported the rally in crude.

Strong Earnings Outlook

We expect the Energy sector to earn $15.2 billion through the January-to-March quarter of 2018, up 33.3% sequentially. Moreover, in the second and third quarters of this year, the sector will likely report earnings of $17.4 billion and $17.5 billion, respectively.

The forward 12-month earnings growth of the Energy sector stands at 88.6% on 18.4% higher revenues. On top of that, for 2018 and 2019, we project earnings of $66.9 billion and $72.6 billion, significantly higher than 2017 profits.

The primary factors driving the expectations are tax cut and crude recovery. The Energy sector has long been a major tax payer with a median tax rate of 36.8% for the last 11 years, per the corporate tax calculator of MarketWatch. With a 21% tax rate, oil and gas companies will definitely save a lot of money, which could be directed toward growth and maintenance projects.

Moreover, major energy players have started banking on the partial crude recovery. Global crude demand will also be a driving factor, believes The Goldman Sachs Group, Inc. (NYSE:GS) . The leading investment bank added that although a trade war might affect oil demand slowly, a weaker dollar could nullify the negative impact. This makes Goldman confident about its daily crude demand growth projection of 1.85 million barrels during 2018.

Stocks in Focus

Record low jobless claims, robust jobs addition and healthy GDP numbers have been backing the market’s bull run. The chart provided below clearly shows that after a fall in 2008, the S&P 500 continues to move up at a steady pace, making the stock market significantly overvalued.

.jpg)

However, energy is still undervalued despite its strong fundamentals and excellent earnings history. Picking oil explorers seems to be a smart option at this moment. However, selecting the winning stocks may be a daunting task.

This is where our VGM Score comes in handy. Here, V stands for Value, G for Growth, and M for Momentum, and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

We have narrowed down our search to the following stocks based on a solid Zacks Rank and VGM Score.

Headquartered in Frisco, TX, Comstock Resources, Inc. (NYSE:CRK) is a leading oil and gas explorer with focus on prospective resources. The company surpassed the Zacks Consensus Estimate for earnings in the last four quarters, the average positive surprise being 33.3%.

We also expect the company to report earnings growth of 34.9% and 11.1% in 2018 and 2019, respectively. Comstock carries a Zacks Rank #2 (Buy) and a VGM Score of B.

EOG Resources, Inc. (NYSE:EOG) , headquartered in Houston, TX, is among the leading crude explorers. The company’s proved reserves spread over the U.K., China and the United States.

The upstream player, with a VGM Score of B, posted an average positive earnings surprise of 25.7% for the prior four quarters. Also, in 2018 and 2019, the company will likely witness respective earnings growth of 260.7% and 18.9%.

EOG Resources sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Dallas, TX, Pioneer Natural Resources Company (NYSE:PXD) is a prime oil and gas explorer. The company beat the Zacks Consensus Estimate for earnings in each of the prior four quarters, the average positive surprise being 66.9%. For 2018 and 2019, Pioneer Natural will likely post earnings growth of 185.7% and 37%, respectively.

This Zacks #1 Ranked firm carries a VGM Score of B.

W&T Offshore, Inc. (NYSE:WTI) , headquartered in Houston, TX, is also a leading oil and gas explorer and producer with focus on the coast of Gulf of Mexico. The company beat the Zacks Consensus Estimate for earnings in three of the preceding four quarters.

We expect the company to post earnings growth of 7.2% and 1.7% in 2018 and 2019, respectively. The #1 Ranked player has a VGM Score of A.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

Comstock Resources, Inc. (CRK): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

W&T Offshore, Inc. (WTI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.