- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Buy 5 Blue-Chip Stocks At A Bargain To Tap Stellar Dow Rebound

On Mar 2, the Dow has recovered some lost ground on news that several major central banks worldwide are likely to take initiatives to stimulate the global economy, which is currently grappling with the severe coronavirus outbreak. In fact, even other major stock indexes like the S&P 500 and the Nasdaq Composite, and European stock indexes witnessed significant turnaround on the same day.

Dow Makes a Historic Comeback

The 30-stock Dow — popularly known as Wall Street’s Blue-Chip index — rallied 5.1% or 1,293.96 points to close at 26,703.32. While historically this was the index’s biggest single-day gain on a pointwise basis, it was also its largest percentagewise gain since March 2009.

Notably, the blue-chip index plunged 13.4% in the previous seven trading days and had entered the correction territory in the previous week. Following Monday’s gain, the index is out of correction territory and is 9.7% away from its recent high (also all-time high) of 29,568.57 recorded on Feb 12.

Speculation Over Global Monetary Stimulus

Global equity investment space was rife with speculations that several large central banks will take a concerted effort to stimulate the global economy in order to minimize the impact of the coronavirus outbreak.

The Bank of Japan boosted investor confidence with announcement that it would provide "ample liquidity" to keep financial markets stable and bolster liquidity through short-term lending operations and asset purchases. The Bank of England also pledged to do what's necessary for the British economy's stability. The Reserve Bank of Australia reduced cash rate by 25 basis-points to a new low of 0.5%.

Christine Lagarde, president of the European Central Bank said “The ECB stand ready to take appropriate and targeted measures, as necessary and commensurate with the virus-related risks." In the United States, in a rare and unscheduled statement, Federal Reserve Chairman Jerome Powell reiterated Fed’s intention to act accordingly to address the risks posed by the coronavirus.

Notably, per the CME FedWatch, at present 100% probability is assigned for a 50 basis point rate cut in March. This probability was just 23% on Feb 28. Moreover, 100% probability is assigned for two more rate cuts of 25 basis-points by June. (Read More: Will Fed Cut Rate in March Amid Virus Threat? Possible Gainers)

Additionally, finance ministers and central bankers of seven largest industrialized nations (the G-7) will hold a conference call on Mar 3, in order to figure out financial and economic measures to counter coronavirus-led challenges.

Silver Lining Emerges

Globally, coronavirus has infected more than 90,000 people in 55 countries and claimed lives of over 3,000 patients. The trend is likely to continue, consequently, volatility will persist as well and investors will be on tenterhooks.

However, stocks across various sectors and industries have taken a severe hit in February. A large section of financial researchers and industry experts had been raising the alarm regarding the overvaluation of equities since the beginning of this year. In fact, most were calling for a more or less 10% corrections. Last week, all three major stock indexes fell more than 10% and went in to correction mode.

Consequently, several blue-chip stocks are currently available at highly discounted prices. Nevertheless, the U.S. economy remained stable despite the coronavirus outbreak. The ISM manufacturing index reported that the sagging manufacturing sector expanded in February albeit at a slow pace than January. Notably, this index had been contracting for last four months of 2019 but expanded in February despite facing severe virus-led threat.

Our Top Picks

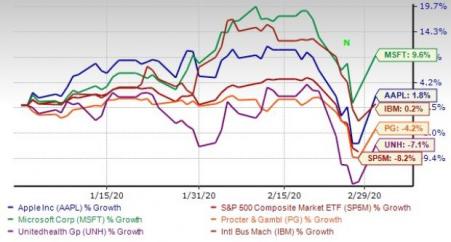

All most all Dow stocks have plummeted in the last eight to10 trading days along with the index. However, we have narrowed down our search to five stocks with strong growth potential and provided either positive return or lower-than Dow’s loss year to date. Each of our picks carry either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Microsoft Corp. (NASDAQ:MSFT) : The developer and manufacturer of Windows operating system and MS-Office software package plummeted 13.5% during Feb 20 to 28. After adjusting for 6.7% gain on Mar 2, the stock price is still 10.4% below its 52-week high recorded on Feb 11. The company has an expected earnings growth rate of 18.3% for the current year (ending June 2020). The Zacks #1 Rank stock carries a dividend yield of 1.26%.

Apple Inc. (NASDAQ:AAPL) : The developer and manufacturer of iPhone, iPAD and iOS software plunged 15.5% during Feb 20 to 28. After adjusting for 9.3% gain on Mar 2, the stock price is still 9.7% below its 52-week high recorded on Jan 29. The company has an expected earnings growth rate of 14.8% for the current year (ending September 2020). The Zacks #2 Rank stock carries a dividend yield of 1.13%.

International Business Machines Corp. (NYSE:IBM) : The leading provider of advanced IT solutions, including computer systems, software, storage systems and microelectronics tumbled 13.7% during Feb 20 to 28. After adjusting for 3.2% gain on Mar 2, the stock price is still 18.2% below its 52-week high recorded on Feb 6. The company has an expected earnings growth rate of 4.3% for the current year. The Zacks #2 Rank stock carries a dividend yield of 4.98%.

The Procter & Gamble Co. (NYSE:PG) : The leading provider branded consumer packaged goods in North and Latin America, Europe, the Asia Pacific, Greater China, India, the Middle East, and Africa depreciated 9.7% during Feb 20 to 28. After adjusting for 5.6% gain on Mar 2, the stock price is still 7.1% below its 52-week high recorded on Feb 6. The company has an expected earnings growth rate of 10.2% for the current year (ending June 2020). The Zacks #2 Rank stock carries a dividend yield of 2.63%.

UnitedHealth Group Inc. (NYSE:UNH) : The diversified health care and well-being operator fell 16.5% during Feb 20 to 28. After adjusting for 7.1% gain on Mar 2, the stock price is still 12.3% below its 52-week high recorded on Feb 19. The company has an expected earnings growth rate of 9% for the current year. The Zacks #2 Rank stock carries a dividend yield of 1.69%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Original post

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.