- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Burlington Stores (BURL) Up On Q4 Earnings Beat & Solid View

Burlington Stores, Inc. (NYSE:BURL) continued with its positive earnings surprise streak in the fourth quarter of fiscal 2017. Also, net sales surpassed the Zacks Consensus Estimate, after missing the same in the preceding quarter. Following the results, the company’s shares were up 5.8% yesterday.

The company’s adjusted earnings of $2.17 a share outpaced the Zacks Consensus Estimate of $2.09. The bottom line was also up from the year-ago figure of $1.78. Higher sales, margin expansion, cost control and share repurchase activity led to the improvement.

Net sales of this Zacks Rank #2 (Buy) company came in at $1,936.8 million, increasing 14.9% year over year. The reported figure surpassed the consensus mark of $1,882 million. Comparable store sales (comps) rose 5.9% in the quarter compared with 4.6% growth in the year-ago quarter.

In fact, this was the 20th straight quarter of comps growth and the reflection of the same is quite visible in Burlington Stores’ price performance. In the past six months, the stock has surged 40.1% comfortably outperforming the industry’s gain 17.3%.

Gross margin increased 20 basis points to 42% mainly owing to higher merchandise margin. While adjusted operating income increased 17% to $250 million, operating margin grew 20 basis points to 12.9%.

Adjusted EBITDA was up 17% to $298 million, while EBITDA margin, as a percentage of sales, expanded 30 basis points to 15.4% on account of higher gross margin. Management anticipates adjusted EBITDA margin expansion of 30-40 basis points in fiscal 2018.

Currently, this off-price retailer intends to focus more on categories such as home, beauty and ladies apparel. Furthermore, Burlington Stores remodeled 34 stores and opened 37 net new stores in fiscal 2017. It plans to open 35 to 40 net new stores in fiscal 2018.

Per the company, there is room to increase the store count to 1,000. Notably, it operated 629 stores at the end of the fiscal fourth quarter. Management informed that new and non-comp outlets contributed $79 million to the fourth-quarter sales.

Other Financial Aspects

Burlington Stores ended the quarter with cash and cash equivalents of $133.3 million, long-term debt of $1,113.8 million and shareholders’ deficit of $86.8 million. For fiscal 2018, the company projects net capital expenditures of approximately $250 million.

In the quarter under review, the company bought back 457,528 shares worth $52 million. At the end of the quarter, Burlington Stores had $217 million remaining under its current share buyback program.

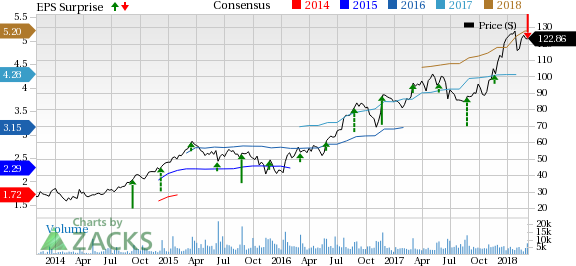

Burlington Stores, Inc. Price, Consensus and EPS Surprise

Outlook

For fiscal 2018, management expects total sales to increase in the band of 9-10%, excluding the 53rd week. Comps growth is anticipated in the 2-3% range compared with the prior year’s gain of 3.4%. The company envisions fiscal 2018 adjusted earnings in the range of $5.73-$5.83 per share compared with $4.14 (excludes the impact of 53rd week) in the previous year.

For the first quarter of fiscal 2018, earnings are envisioned to come within the range of $1.05-$1.09 per share compared with 79 cents in the prior-year period. Further, sales and comparable sales are expected to lie within 9.5% to 10.5% and 2% to 3%, respectively.

The Zacks Consensus Estimate for the first quarter and fiscal 2018 is pegged at 99 cents and $5.20, respectively.

Looking for More? Check These Three Trending Retail Stocks

Dollar Tree, Inc. (NASDAQ:DLTR) has a long-term earnings growth rate of 13.9% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar General Corporation (NYSE:DG) pulled off an average positive earnings surprise of 3.7% in the trailing four quarters. It has a long-term earnings growth rate of 11.6% and a Zacks Rank of 2.

Target Corporation (NYSE:TGT) delivered an average positive earnings surprise of 10.7% in the trailing four quarters.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.