- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Burlington Stores' (BURL) Q4 Earnings Beat Estimates, Rise Y/Y

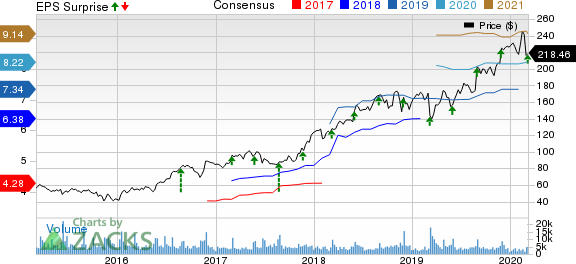

Burlington Stores, Inc. (NYSE:BURL) delivered robust bottom-line results in fourth-quarter fiscal 2019. Earnings not only grew year over year but also outshined the Zacks Consensus Estimate for the third straight time. Although the top line lagged the consensus mark, the same improved year over year on impressive comparable store sales and solid contributions from new and non-comparable stores.

Notably, Burlington Stores is on track with its strategic initiatives. Management will now focus on higher investment in merchandizing capabilities, operating with leaner inventories, enhancing operational flexibility and controlling costs. In addition, the company has decided to wind down e-commerce operations, which represented nearly 0.5% of total sales. The decision will enable the off-price retailer to focus more and deploy resources in the bricks-and-mortar platform.

Let’s Introspect

The company delivered fourth-quarter adjusted earnings (exclusive of management transition costs) of $3.25 per share that surpassed the Zacks Consensus Estimate of $3.22. Notably, earnings rose 14.8% from the prior-year quarter on higher net sales, merchandise margin improvement and leverage on SG&A.

Net sales advanced 10.5% year over year to $2,201.4 million. However, the reported figure lagged the consensus mark of $2,206 million, marking the second consecutive quarterly miss. New and non-comparable stores contributed $151 million to sales. Other revenues came in at $7.2 million, up 9.1% year over year.

Meanwhile, comparable store sales rose 3.9% in the reported quarter, up from an increase of 2.7% in the preceding quarter. Comps growth was mainly backed by rise in units per transactions with AUR and a marginal increase in conversions, somewhat offset by a slight fall in traffic. Notably, this was the 28th successive quarter of comparable store sales growth.

Gross margin grew 20 basis points (bps) to 42.1%, driven by an increase of 40 bps in merchandise margin, partly offset by higher freight costs.

Adjusted SG&A expenses, as a percentage of net sales, declined 20 basis points to 22.5% owing to sturdy sales growth that led to leveraged occupancy and marketing expenses, and corporate costs. This excludes management transition costs of $2.9 million incurred during the reported quarter.

Adjusted operating income (exclusive of management transition costs) improved 13.6% to $296.8 million, while adjusted operating margin, as a percentage of net sales, expanded 40 bps to 13.5%.

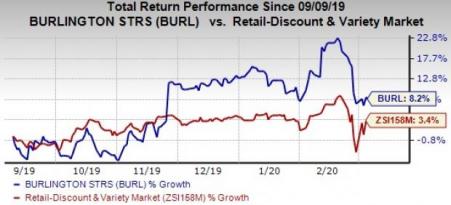

Over the past six months, shares of this Zacks Rank #2 (Buy) company have gained 8.2%, outperforming the industry’s 3.4% rise.

Store Update

During fiscal 2019, Burlington Stores opened 76 new stores and shuttered 24 stores. The company concluded the quarter with 727 stores. During fiscal 2020, it plans to open 80 new and close or relocate 26. This reaches the expected net new store opening count for fiscal 2020 to 54.

Other Financial Aspects

Burlington Stores ended the reported quarter with cash and cash equivalents of $403.1 million, long-term debt of $1,001.7 million and shareholders’ equity of $528.1 million. Net capital expenditures incurred during fiscal 2019 totaled $269 million. For fiscal 2020, the company projects net capital expenditures of roughly $400 million.

Further, merchandise inventories were $777.2 million, down 18.6% from last year. The decline was mainly due to a 15% fall in comparable store inventory at the end of the fiscal coupled with decrease in pack and hold inventory that constituted 26% of total inventory by fiscal-end.

During the quarter, the company bought back 375,529 shares for $83 million. At the end of the reported quarter, the company had $399 million remaining under its share buyback program.

On Feb 26, management completed the repricing of the senior secured term loan facility. This lowered the applicable interest rate margin to 1.75% from 2%, with a 0.00% LIBOR floor. Further, the senior secured term loan facility includes a single tranche of loans, having a maturity date in November 2024.

Outlook

For fiscal 2020, management now projects total sales growth of 8-9%, compared to fiscal 2019 sales growth of 9%. Further, comparable store sales are forecasted to improve 1-2%. The company had witnessed comparable store sales growth of 3% in fiscal 2019.

Further, depreciation and amortization, exclusive of favorable lease expenses, are likely to come in at roughly $235 million. Adjusted EBIT margin rate is likely to remain flat year over year. It estimates net interest expense of about $45 million and an effective tax rate of 21% for the fiscal year.

Burlington Stores now envisions fiscal 2020 adjusted earnings per share in the range of $7.97-$8.12, suggesting an improvement from adjusted earnings of $7.41 reported in fiscal 2019. However, the guided range fell short of the current Zacks Consensus Estimate of $8.22.

Additionally, the company expects first-quarter total sales growth of 8-9%. Comparable store sales are anticipated to improve 1-2% compared with flat comparable store sales reported in the year-ago period. It envisions adjusted earnings per share of $1.29-$1.34, suggesting a rise from the prior-year adjusted figure of $1.26 but way below the Zacks Consensus Estimate of $1.42.

More Key Picks in Retail

Stitch Fix, Inc. (NASDAQ:SFIX) has an expected long-term earnings growth rate of 15% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zumiez Inc. (NASDAQ:ZUMZ) , also a Zacks Rank #1 stock, has an expected long-term earnings growth rate of 12%.

Costco Wholesale Corporation (NASDAQ:COST) has a long-term earnings growth rate of 7.6%. The stock carries a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Stitch Fix, Inc. (SFIX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.