- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bullish Haramis Attempt To Establish Swing Lows

There was a reluctance on the part of traders to react to the bearishness of Friday' trading, although yesterday's buying came on significantly lower volume. The 'inside day' of Monday's trading ranks as a bullish harami over the last two trading days—a bullish pattern.

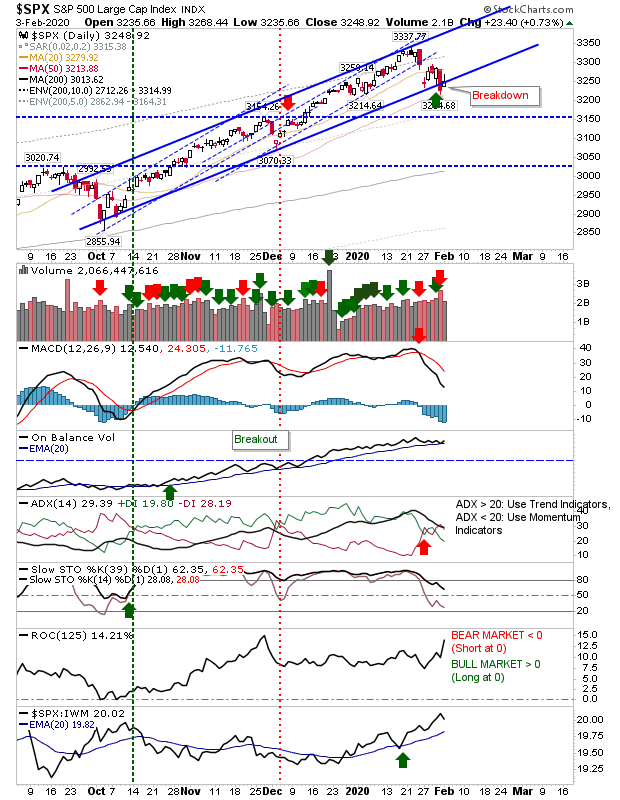

For the S&P, this buying didn't contribute much to arresting Friday's selling volume as many of the indices failed to recover channel support. Relative performance remains strong (versus Small Caps) although other technicals are drifting, the MACD in particular. Some could argue yesterday's buying marked a return to channel support, but it's not a substantial recovery.

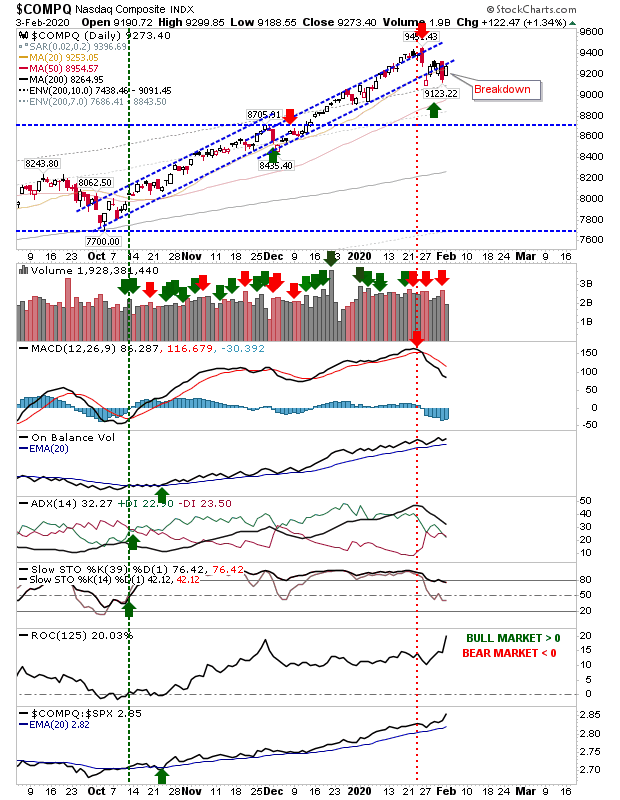

The NASDAQ enjoyed twice the gain of the S&P, but it too found itself just about making it back to channel support.

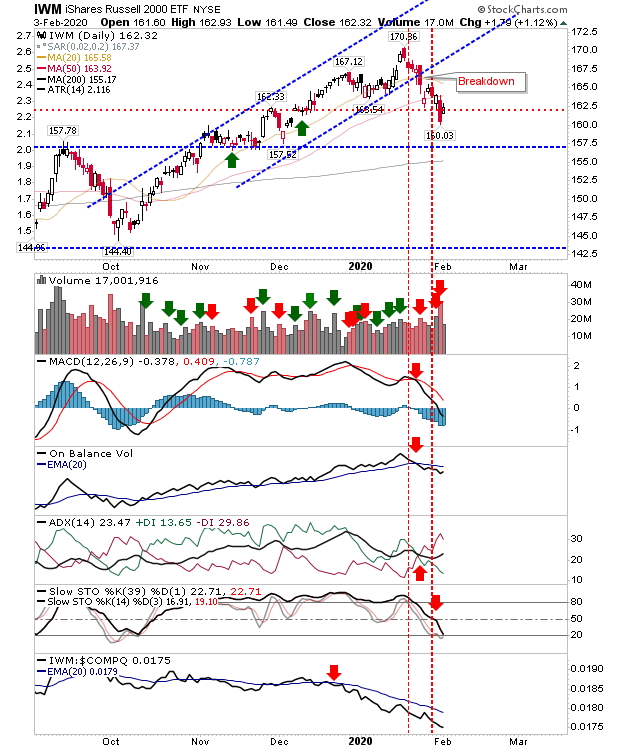

Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) are a long way from returning to channel support, but there is a minor horizontal support level which is protecting against further losses. All technicals are bearish as intermediate and long-term stochastics converge at an oversold condition.

Collectively, yesterday's action is an attempt to establish a ground zero for buyers to set up a launch point for a new rally but it's probably still a little early. With the flu epidemic in its early days, the risk to the global supply and consumer chain remains up in the air. Until infection counts peak it would remain difficult to time call a tradable bottom.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.