- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bull of the Day: KB Home (KBH)

KB Home (NYSE:KBH) KBH continues to see strong demand for new homes and is able to navigate supply chain challenges heading into 2022. This Zacks Rank #1 (Strong Buy) is expected to grow earnings by another 49% this year.

KB Home is one of the largest home builders in the country with homes in 47 markets from coast-to-coast.

Another Earnings Beat in the Fourth Quarter of 2021

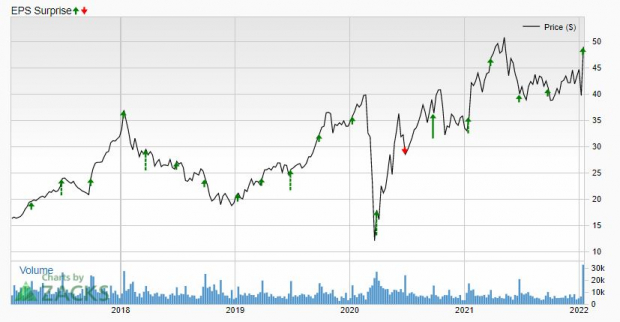

On Jan 12, KB Home reported its fourth quarter 2021 results and blew by the Zacks Consensus Estimate by $0.14.

Earnings were $1.91 versus the Zacks Consensus Estimate of $1.77. It was the 6th earnings meet or beat in a row.

But KB Home has a great track record of beating, with just one miss in the last 5 years and it was when the pandemic first broke out, which sent the home building industry into an initial spiral.

That initial hit on business quickly faded as demand returned with buyers even buying remotely after touring homes online. It has been red hot ever since.

Revenue in the fourth quarter was up 40% to $1.68 billion as homes delivered jumped 28% to 3,679.

KB Home continued to have pricing power as demand remained strong with average selling price increasing 9% to $451,100.

Gross profit margin increased 230 basis points to 22.3%. Excluding inventory-related charges, the housing gross profit margin improved to 22.4% from 21%.

The improvement in gross profit margin was achieved through a favorable pricing environment due to strong demand and the limited supply of available homes for sale, and lower relative amortization of previously capitalized interest, partly offset by higher construction costs, particularly elevated lumber prices.

Ending backlog value jumped 67% to $4.95 billion as supply chain issues for things like garage doors and appliances have increased delivery times.

It was KB Home's highest fourth quarter backlog level since 2005. Each of the company's four regions generated increases which ranged from 53% in the West Coast to 106% in the red hot Southeast.

Total homes in the backlog rose 35% to 10,544.

For the year, revenue rose 37% to $5.72 billion as Americans moved during the pandemic and many wanted new homes.

Bullish on 2022

Despite Wall Street believing the demand for homes is "over" after a blistering 2-year period, KB Home said on its conference call that it believes demand will be strong again in 2022, as existing home inventory remains low and Millennials, the largest generation in American history, continues to buy homes.

KB Home's 2022 guidance was bullish.

It's looking for another big jump in revenue, in the range of $7.2 billion to $7.6 billion as the average selling price continues to move higher, in the range of $480,000 to $490,000.

KB Home said on the conference call that it wasn't worried about higher mortgage rates dampening demand.

Even with inflationary pressures and lumber prices on the move higher again, housing gross profit margin is expected in the range of 25.4% to 26.2% for the year.

Analysts Raise Earnings Estimates for F2022 and F2023

The analysts were equally as bullish as 3 estimates were raised for fiscal 2022 and one for fiscal 2023 since the earnings report.

The fiscal 2022 Zacks Consensus Estimate jumped to $9.03 from $7.88 in the last week. That's earnings growth of 49.3% as KB Home made $6.05 last year.

Fiscal 2023 also jumped to $11.04 from $8.87 over the last 7 days. That's further earnings growth of 22.2%.

Shares are Dirt Cheap

Shares of KB Home jumped 19.4% in the last week on the earnings report and are up 37.1% over the last year.

However, they haven't yet taken out the spring 2021 highs.

Over the last 2-years, shares of KB Home have lagged the S&P 500, with KBH gaining 33.2% versus the S&P 500's gain of 57.7% during that time.

They remain dirt cheap with a forward P/E of just 5.4.

And with the expected earnings growth, KB Home has a PEG ratio of just 0.3.

Shareholders also get a dividend, currently yielding 1.2%.

Why Aren't the Shares Soaring?

The Street is worried about rising rates and "peak" earnings. Over the last year, they've been wrong.

For investors looking for a value stock with rising earnings estimates, KB Home is one to keep on the short list.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the Zacks Top 10 Stocks portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KB Home (KBH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.