- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bull Of The Day For 11/10: Groupon (GRPN) (Revised)

Actor and comedian Tiffany Haddish recently stopped by Jimmy Kimmel Live, and hilariously described a time when she bought a Groupon for a Cajun swamp tour for her and Will & Jada Pinkett Smith—seriously, watch the interview, it will be the funniest thing you’ll see all day—giving Groupon (NASDAQ:GRPN) a ringing endorsement it probably didn’t even know it needed.

The company is known for just that: random deal-of-the-day recommendations. You can score deals on restaurants, fitness, travel, and even Cajun swamp tours at bargain prices. Groupon is focused on connecting people with small businesses in their community and building voucher-less customer experiences.

Groupon is headquartered in Chicago, but you can find deals in cities across the U.S. and Canada, as well as Europe, Australia and Japan.

Impressive Turnaround

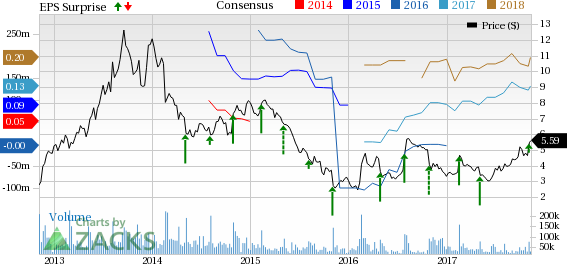

Sitting at a Zacks Rank #1 (Strong Buy), Groupon has been on an impressive rebound lately. Despite posting mixed third-quarter results, the company’s gross profit and adjusted EBITDA guidance keep climbing.

Earnings per share of a penny came in line with the Zacks Consensus Estimate, marking the fourth consecutive quarter of positive EPS. Revenues, however, declined 8% year-over-year to $634.5 million.

Even though the hurricanes in late August and September negatively impacted North American gross profit, this metric managed to increase 3%, while international gross profit surged 11% year-over-year.

Looking ahead, Groupon raised both its gross profit and adjusted EBITDA guidance range.

It now expects gross profit in the range of $1.305 to $1.355 billion, up from the range of $1.30 billion to $1.35 billion, and adjusted EBITDA in the range of $225 million-$245 million, up from the range of $215 million-$240 million.

Strong Growth Outlook

Groupon is currently witnessing major growth on its bottom line.

Current quarter estimates anticipate earnings to increase over 24%, while the company’s bottom line is projected to rise almost 230% and 50% for the current year and next year, respectively.

And, more and more analysts are revising their earnings estimates upwards for Groupon. Right now, six have shifted their estimate higher in the last 30 days compared to two lower for the current year.

Looking at the long term, Groupon expects earnings to grow 10%.

Shares are Soaring

So far this year, GRPN stock has gained close to 70% compared to the S&P 500’s return of over 15%. Groupon has also performed better than its industry, Internet-Commerce, which is no underperformer by any means; it has returned about 60% year-to-date.

Groupon, though, is an expensive stock if you consider its forward price-to-earnings. Right now, its P/E sits at 42.41 compared to the industry average of 37.4. But, its price-to-sales is a commendable 1.07.

Since CEO Rich Williams took over in late 2015, Groupon has been able to reposition itself as a company where its improvements have now become sustainable.

With consistent profitability, cash-rich status, and growing user base—it ended the third-quarter with 32.5 million active customers—Groupon proves to be an exciting opportunity for investors.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Groupon, Inc. (GRPN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.